SP500 LDN TRADING UPDATE 28/10/25

SP500 LDN TRADING UPDATE 28/10/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6830/40

WEEKLY RANGE RES 6939 SUP 6730

OCT EOM STRADDLE 6542/6951

NOV MOPEX 6951/6339

DEC QOPEX 6243/7085

DAILY STRUCTURE - ONE TIME FRAMING HIGHER - 6877

WEEKLY STRUCTURE - ONE TIME FRAMING HIGHER - 6690

MONTHLY STRUCTURE - ONE TIME FRAMING HIGHER - 6371

DAILY BULL BEAR ZONE 6882/92

DAILY RANGE RES 6971 SUP 6856

2 SIGMA RES 7028 SUP 6800

DAILY VWAP BULLISH 6802

VIX BULL BEAR ZONE 18.5

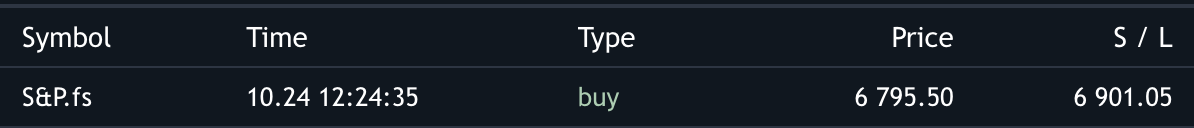

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY RANGE RES

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES COLOUR: TAPE CHASE

S&P rose +123bps, closing at 6,875 with a MOC of +$5.3b to BUY. NDX gained +183bps to 25,821, R2K climbed +34bps to 2,522, and Dow advanced +71bps to 47,544. A total of 19.5b shares traded across all U.S. equity exchanges, surpassing the YTD daily average of 17.3b shares. VIX dropped -373bps to 15.76, WTI Crude edged down -16bps to $61.39, U.S. 10YR fell -1bp to 3.99%, gold declined -324bps to 4,003, DXY slid -14bps to 98.81, and Bitcoin surged +130bps to $114,810k.

Stocks reached new all-time highs on optimism surrounding China and Trump, kicking off a busy week packed with both micro and macro events. Micro focus includes 43% of S&P market cap reporting, particularly the "Mag7" stocks: MSFT, GOOGL, META on Wednesday, and AAPL, AMZN on Thursday. Macro events feature central bank decisions (FOMC and BOC on Wednesday, ECB and BOJ on Thursday) and the Trump-Xi summit in South Korea on Thursday. Right tail risk remains significant, as GS PB highlighted substantial short covering of macro products last week, with nearly all ETF shorts from the prior week covered. Today's market exhibited similar dynamics, with ETF volumes accounting for ~30% of overall tape volumes and a broad "everything-up" price action. Single-stock activity was muted, with major players holding positions in a wait-and-see mode.

The labor market remains under scrutiny amid rising job cut headlines. Today, Paramount and Amazon announced cuts, adding to recent announcements from TGT, AMAT, META, CHTR, RIVN, and TAP. Amazon's Thursday night report is highly anticipated, with AWS growth trends being a key point of contention.

Activity levels on the floor were rated a 4 on a 1-10 scale, finishing roughly flat compared to the 30-day average of -4bps. Client-level skews were benign, with LOs being slight ($600m) net sellers due to supply in macro and HC, while HF flows remained flat. Noteworthy developments include persistent retail bidding, corporates exiting their buyback blackout window today, and the conclusion of heavy mutual fund tax-loss selling this week (22% of active MFs have October fiscal year-end, compared to just 6% in November). Dealers are expected to shift from long $4b gamma (vol suppressant) to short -$6b (vol accelerant) if the S&P 500 approaches 6,925 (+2% from Friday’s close), forcing market makers/dealers to chase higher prices to hedge their books.

DERIVATIVES: Strong spot-up vol-up trends are evident as we outrealize a low straddle, with early signs of FOMO ahead of a catalyst-rich week. The catalyst path is clearly reflected in micro term structures at the front of the curve. Tomorrow's straddle is estimated at 35-40bps despite today's realized move, while Friday’s straddle implies a higher hurdle due to FOMC, mega-cap tech earnings, and the Trump-Xi summit. Alongside the robust vol bid this morning, skew flattening aligns with the spot-vol correlation observed. Additionally, much of the street's gamma positioning now appears to be on the downside, making sharp downward moves less likely. The desk favors long gamma for the next day or two, given the low bar to clear, but prefers flatter vol positioning as implied correlation remains near its lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!