Institutional Insights: Citi 'Crypto Markets Approaching Key Levels'

CITI'S TAKE

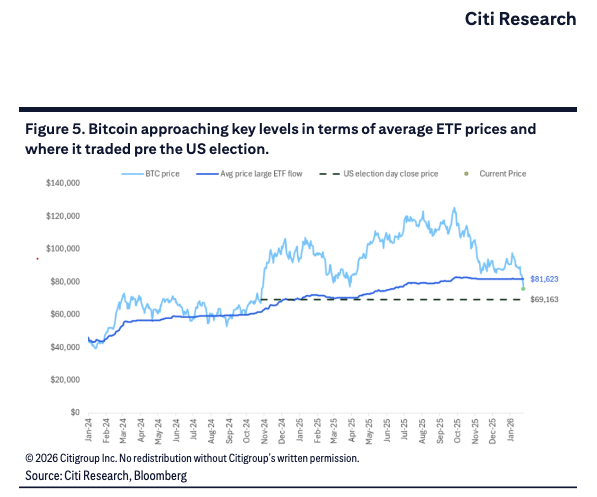

Crypto markets show volatility akin to precious metals but lack significant upside. Bitcoin prices fell to $73k today before slight recovery, remaining below the US spot-ETF entry price of $81.6k and near the $70k pre-election level. ETF flows have dried up, with legislation seen as a potential catalyst for renewed interest. The market structure bill progresses slowly in the Senate.

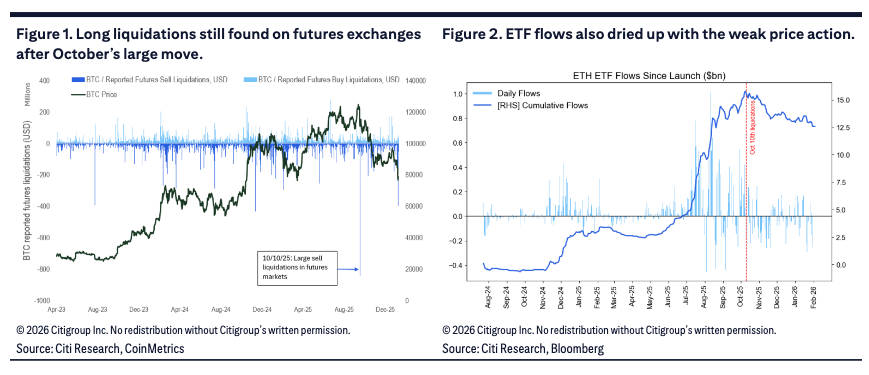

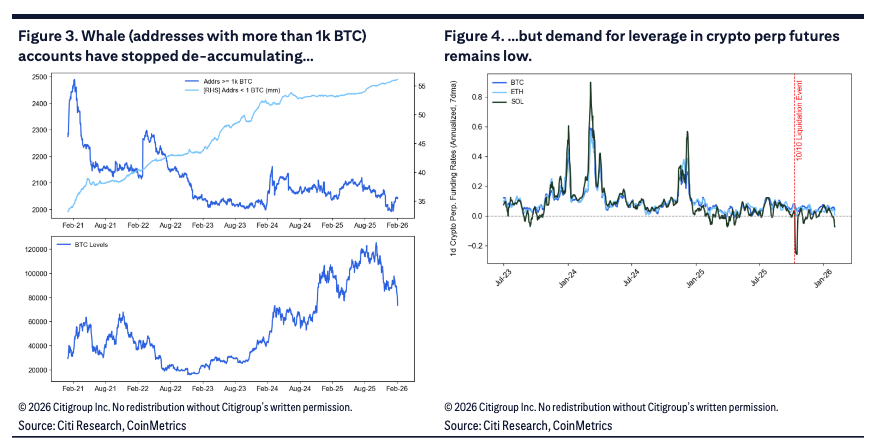

Downside volatility persists — Long liquidations, equity sensitivity, and geopolitical risks weigh on crypto markets.

Regulatory catalysts uncertain — US market structure bill shows slow, uneven progress.

Pre-election $70k level critical — The administration aims to strengthen US leadership in digital assets, making $70k a key level.

Fed balance sheet concerns and winter fears — Crypto remains sensitive to US bank liquidity; a smaller Fed balance sheet may add pressure. While 20% drawdowns are common, prolonged "crypto-winters" are rare.

Crypto markets face downside volatility, with legislation considered a potential sentiment catalyst, though Senate negotiations have slowed. Key levels include an average ETF price of $81.6k and the US pre-election level of $70k. Recent weeks have seen liquidation events, mirroring metals market volatility but lacking upward price movement. Regulatory changes and broader adoption remain key drivers of crypto prices, but since October 10th last year, US spot ETF flows have declined, coinciding with concerns from long-term holders about Bitcoin's cyclical weakness. De-accumulation has recently paused (Figure 3). The anticipated US digital market structure bill, expected to provide regulatory clarity, has seen its passage probability drop from 70% to 59% for 2026, per Polymarket data via Bloomberg. Bitcoin is approaching critical levels, with the average holder now at a loss and prices below the pre-election ~$70k level. ETF flow averages are key, as Bitcoin has dropped below the largest ETF's average daily close (Figure 5). The US election level is also significant, given crypto-advocates' campaign contributions. The current administration aims to strengthen digital asset leadership and has established a Bitcoin strategic reserve, funded by seized Bitcoin and expanded only in a budget-neutral way.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!