Trade of the Day

Trade of the Day

USD: The greenback continued to firm up across the board except against the euro. The Dollar Index was little changed at 99.12. We expect USD strength to generally persist today except for strength in safe haven JPY as the SCMP report casts doubt on a US-China deal. Look towards this week’s trade negotiation outcome and any more Fed speaks to gauge the greenback’s future direction. The Fed’s interest rate outlook remains uncertain at this point but we do not foresee a rate cut at the end of this month. On the data front, US wholesale inventories saw a steady 0.2% MOM increase in August while mortgage applications rose due to higher refinancing activities.

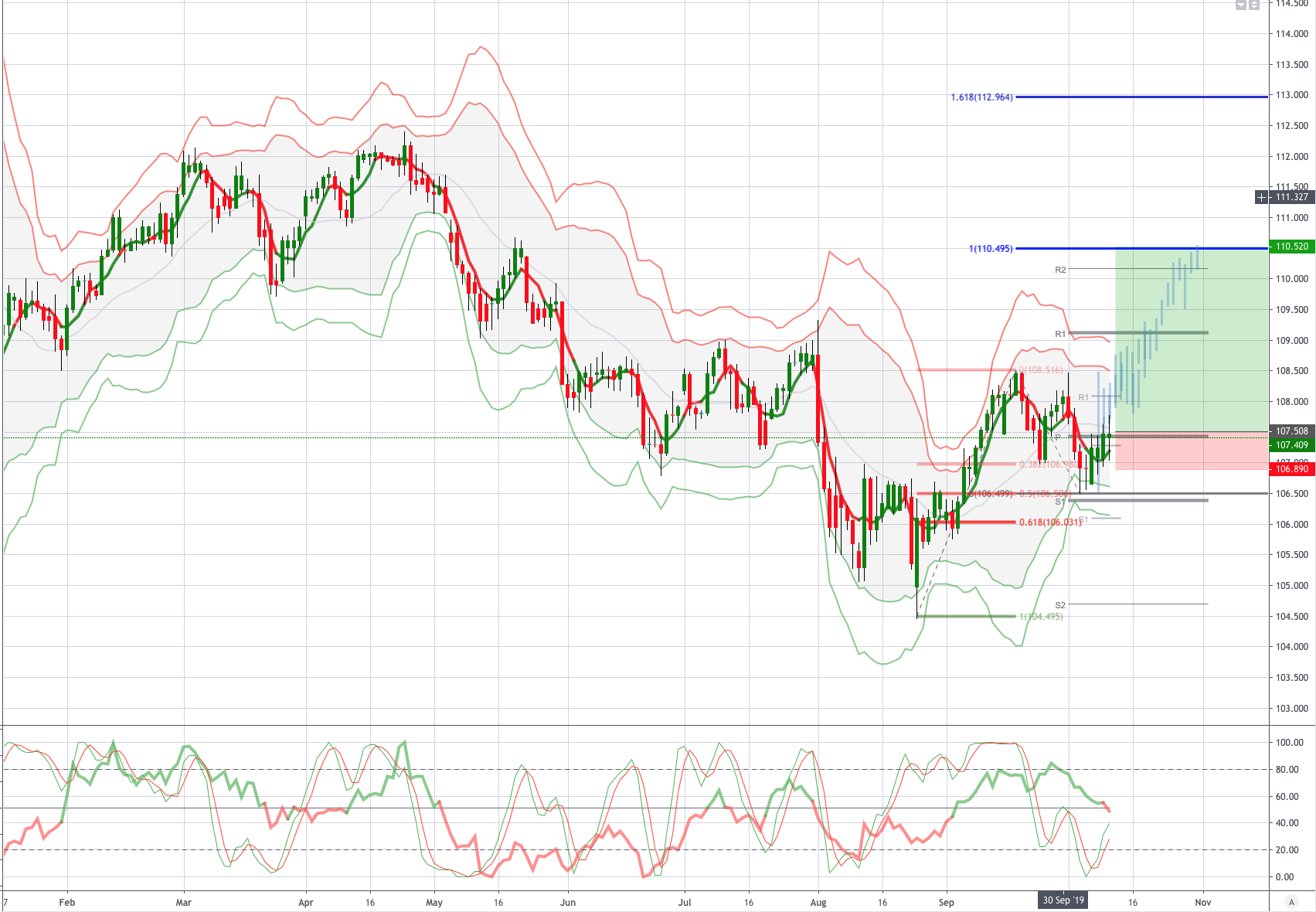

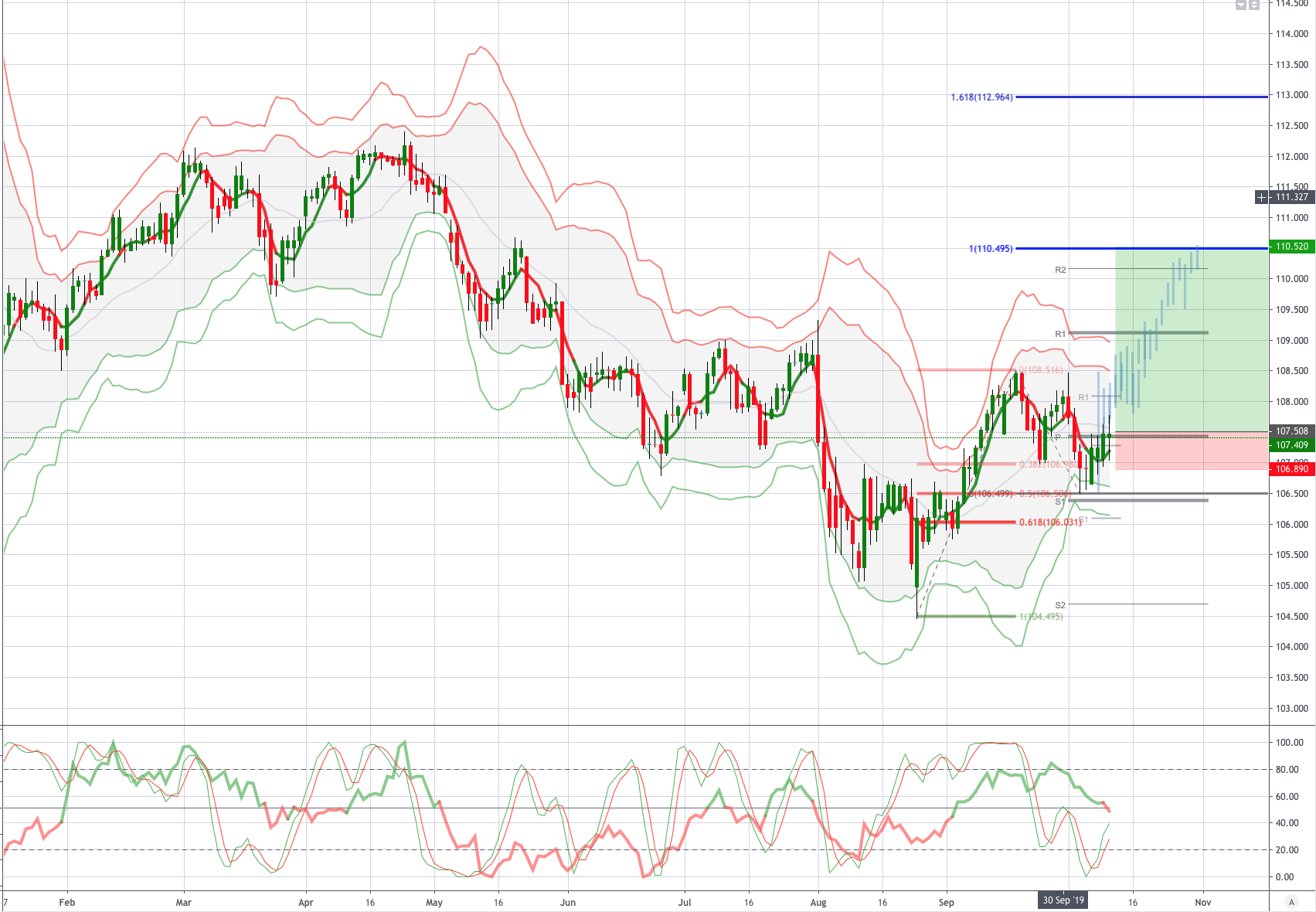

JPY: Japan core machine orders, a key capex gauge slipped again in August whereas the country’s factories were engulfed in a state of deflation as PPI continued to fall for the fourth straight month. JPY to be reactive to Sino-US trade headlines and shifting risk sentiments in the interim, even though the rising short-term implied valuations suggest an underlying upside bias. Resistance may have shifted higher towards 107.80/00, while the support comes in at 107.00 as we wait out the event risk.

From a technical and trading perspective USDJPY has held pivotal 106.50 support which represents the monthly pivot and the weekly S1 as well as the 50% retracement of the September swing higher, the current pullback looks corrective in nature and another leg of upside should now develop, as such I now look to trade the C=D leg of the broader corrective pattern targeting an equality objective towards 110.50, note this trade has significant headline risk over the coming sessions as such I will reduce my position size.

The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organisation, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!