BTC Fails to Rally

Bitcoin bulls remain in a precarious position here as the futures market continues to battle it out around the key $108,855 support level. Despite a promising start to UPtober, Bitcoin prices reversed sharply lower and after a failed recovery rally remain in the red on the month so far. October has typically been one of Bitcoin’s best performing months over the last decade but looks very much on course to be a dud this year. The prospect of a US/China trade deal as well as dovish Fed expectations had seen BTC prices lifting at the start of the week. However, the move quickly reversed lower and the subsequent announcement of a deal and a fresh cut from the Fed has failed to revive bull sentiment. Against this backdrop, risks of a downside break look to be growing with a lack of near-term bullish drivers seen for now.

ETF Outflows Seen

The latest institutional data suggests little cause for optimism. ETF outflows surged to $470 million yesterday, despite the Fed cut and trade deal news. ETFs had seen 3 consecutive days of inflows prior to yesterday suggesting some disappointment with what materialised. On the Fed front, there is a clear tone of uncertainty today after Powell highlighted division within the Fed and the lack of conviction for a furtehr rate cut in December. Another rate cut ahead of year end had looked like a guarantee ahead of the meeting, reflected by the roughly 95% market pricing w saw on the CME. However, that pricing has since dropper to around 70%. If we see any furtehr trailing off of easing expectations this could lead BTC to a breakdown near-term as traders reallocate based on a shifting Fed view.

Technical Views

BTC

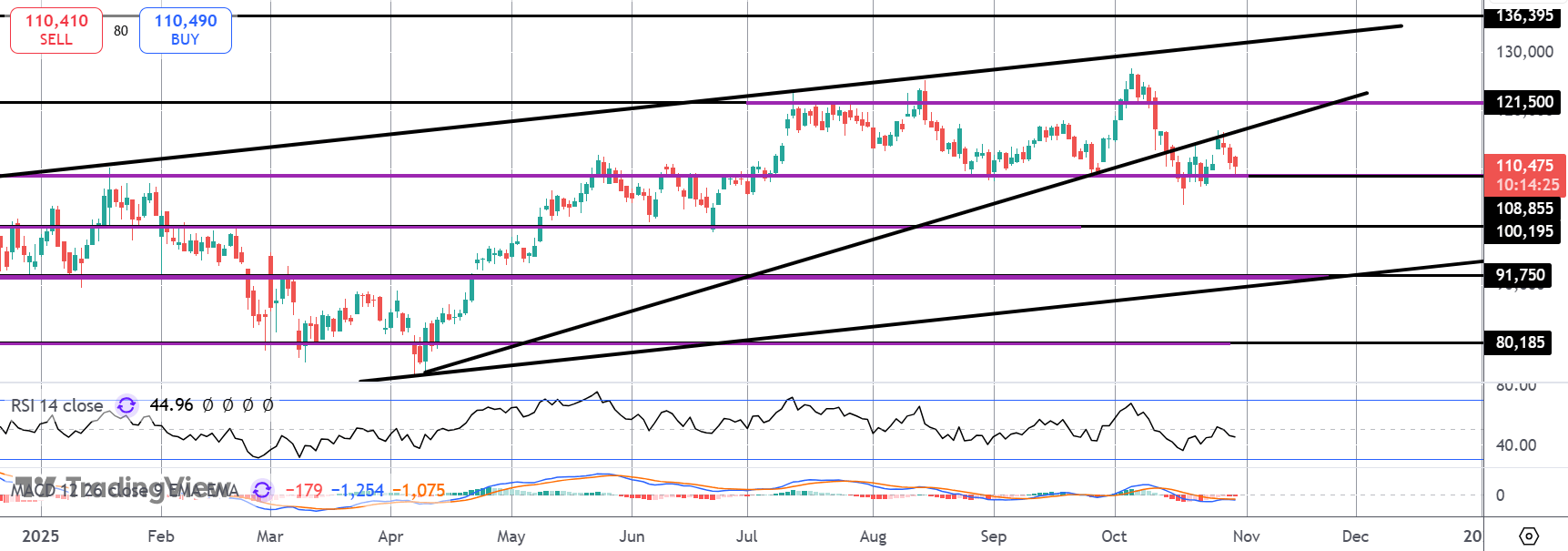

For now, BTC remains caught between support at the $108,855 level and resistance at the broken bull trend line overhead. While support holds, the consolidation is a viewed as a bullish pause with focus on an eventual break higher and fresh test o the $121,500 level and YTD highs. However, should support break, a test of deeper support at the $100k mark will the be the focus.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.