Risk Aversion Weighs on Paypal Ahead of Earnings

Paypal Earnings on Deck

US payment systems company Paypal is due to report Q2 earnings today and, on the back of 5 consecutive quarters of earnings growth, traders are keen to see if the company can make that 6. On the numbers front, the market is looking for EPS of $1.154 on revenues of $7.274 billion. If seen, this will mark an increase on the prior quarter’s results and should help underpin the stock near-term.

Risk Aversion Weighing on Stocks

However, the bigger issue currently is the broader risk off move we’re seeing. On the back of some weaker-than-forecast US data yesterday and a credit ratings downgrade from Fitch, US stocks have come under heavy selling pressure as traders move capital into defensive positions. Against this backdrop, if Paypal results come in weaker than expected this might fuel a sharp unwinding of the stock, particularly given that Payapl shares are already trading lower ahead of the open today.

Technical Views

Paypal

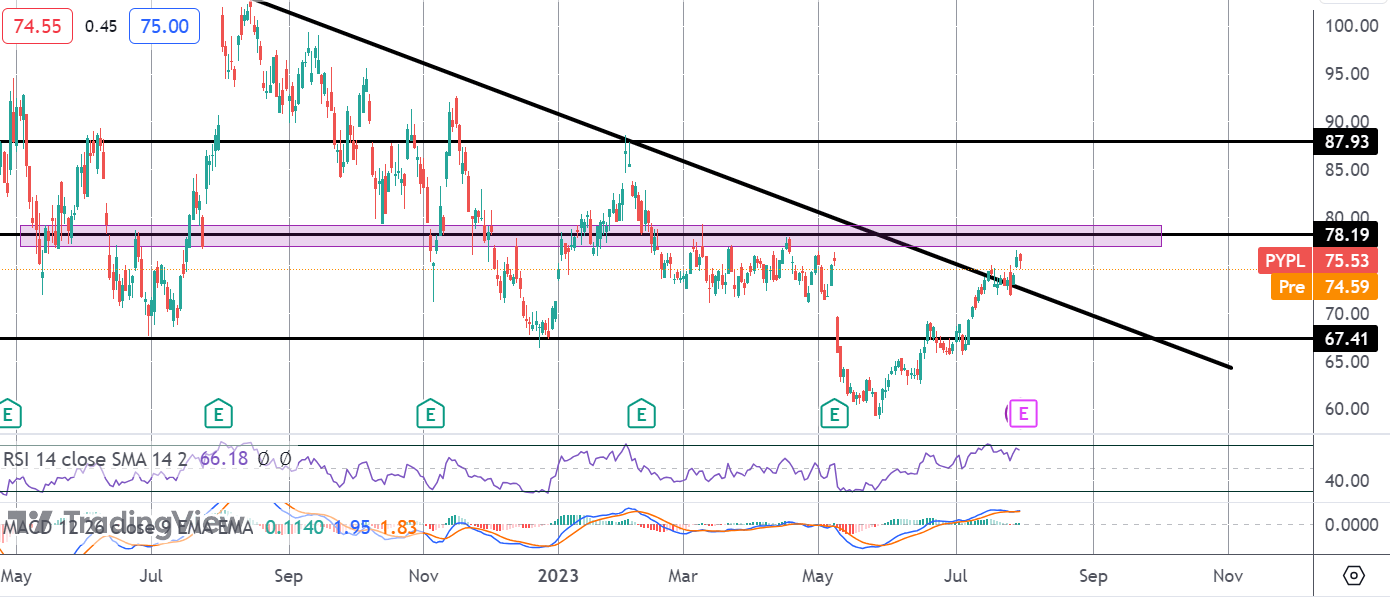

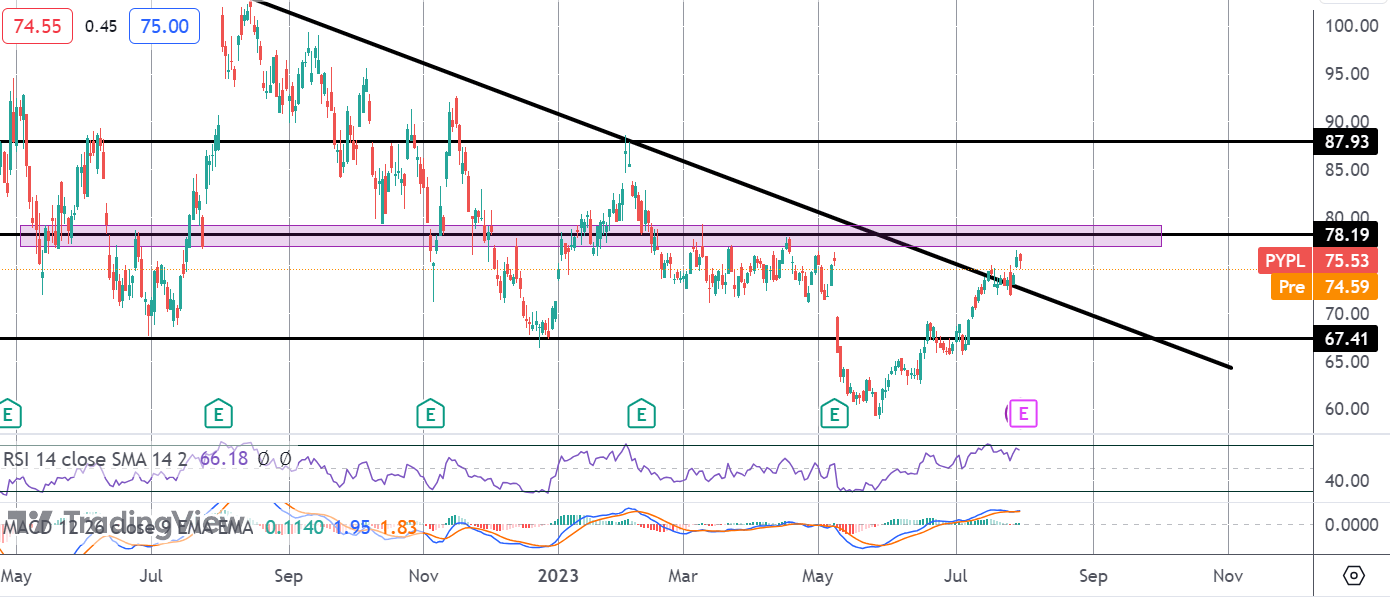

Shares in Paypal have recently broken out above the bearish trend line from last year’s highs but are still sitting below the 78.19 level for now. This is a major resistance zone for the stock and bulls will need to see a break higher here to prevent a fresh rotation lower. If we do turn lower from that level, 67.41 is the key support area to watch. To the topside, a break of 78.19 will open the way for a move up to 87.93 thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.