Unemployment Rises, Wages Fall

The British Pound is pushing lower this morning on the back of the latest UK labour market data released today. The unemployment rate was seen unexpectedly jumping to 4.3% from 4% prior, above the 4.1% the market was looking for. The data released by the ONS today also showed that regular pay, excluding bonuses, fell back to 4.8% from 4.9% in the three months through September. The data comes amidst a recent downturn in traders’ BOE easing expectations. The market has recently downgraded pricing for a further cut in December, though the reaction in GBP today suggests that this pricing is likely creeping back up a bit.

BOE’s Pill on Watch

Looking ahead, we have a speech from the BOE’s chief economist Huw Pill later today which will be closely watched. Given that Pill dissented against the August rate cut call, there are hawkish risks into today’s speech which could stem the selling in GBP if we get anything of note from Pill. On the data front, focus will then turn to monthly GDP and prelim quarterly GDP on Friday. Given the weakness in today’s data, any further weakness on Friday could see those December easing expectations starting to move higher again, leading GBP further lower through the end of the week.

Technical Views

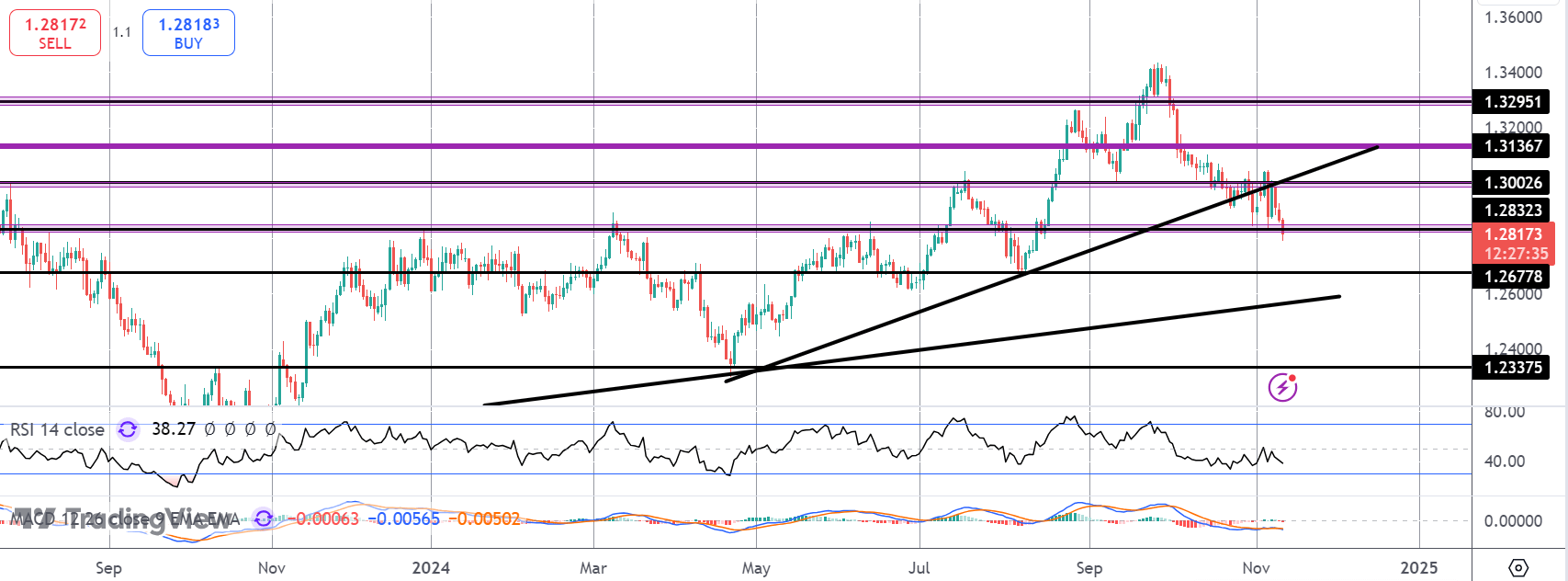

GBPUSD

Price is now testing below the 1.2832 support level as the breakdown below the bull trend line continues. While below 1.2832 the focus is on a deeper push towards 1.2677 next and the bull trend line off 2023 lows beneath. Topside, bulls need to get back above 1.30 to ease downside pressure.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.