Market Spotlight: Paris Overtakes London As Europe's Top Stock Market

Paris vs London

Rivalry between London and Paris traders undoubtedly increased this week amidst news that the Paris stock exchange overtook London in value for the first time since record started in 2003. According to Bloomberg, the Paris stock exchange is now worth roughly EUR 2.823 trillion, while the London stock exchange is worth EUR 2.821 trillion.

UK Midweights Suffering

The switch in positions has been mainly attributed to the sharp underperformance of UK mid-weighted firms which have been hampered this year by a weaker GBP, higher energy costs and ongoing supply issues (Brexit/covid). Additionally, the cost-of-living crisis has hit UK consumers hard, weighing on demand for these companies' products and services.

French Luxury Brands Booming

While the UK stock market has been in rough waters, the French stock market has actually seen a boost this year, linked largely to increased sales from luxury fashion brands. With the return of Chinese demand this year, shares in companies such as Lous Vuitton and Chanel have soared, lifting the overall stock market price.

Brexit Woes

In truth, the London stock market has been on the decline since the Brexit referendum in 2016. The legal activation of Brexit has obviously exacerbated this with many investment banks moving back to Paris and Berlin or moving large numbers of traders away from the city. With London now losing the top spot in Europe, political pressure on the government will no doubt increase.

Technical Views

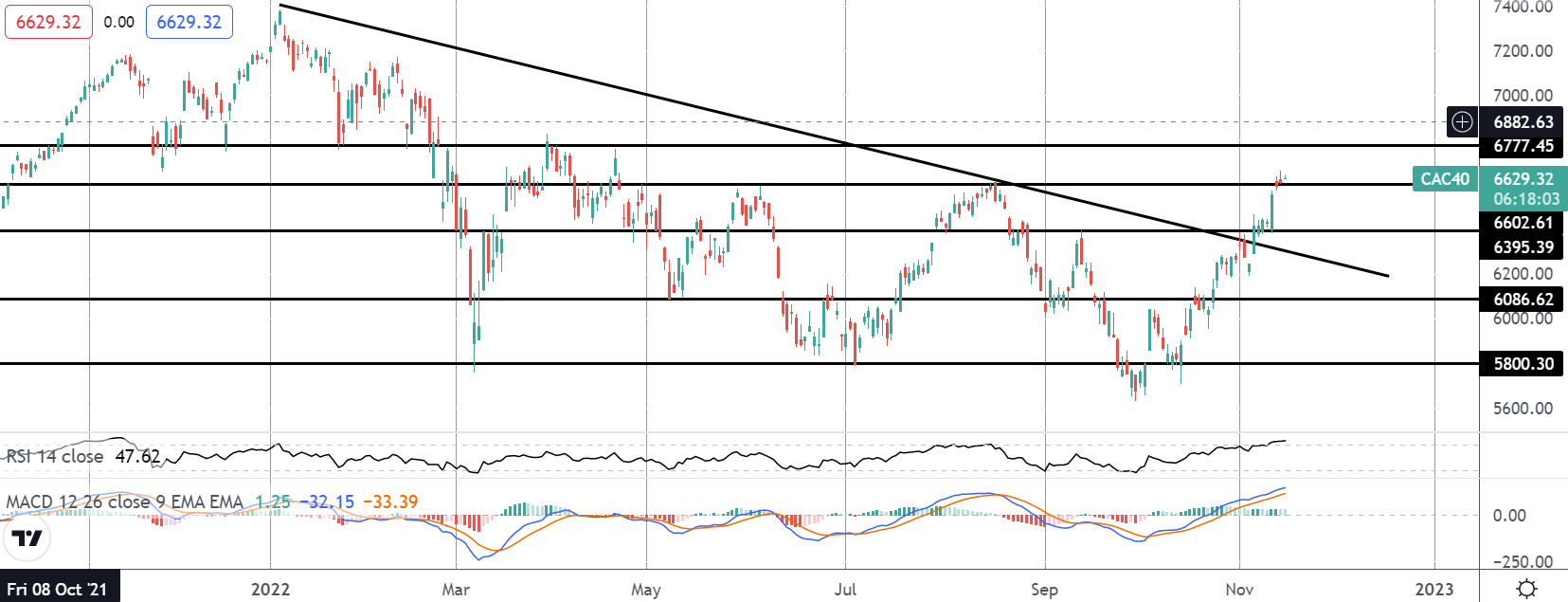

CAC 40

The rally in the CAC 40 this year has seen the market advancing more than 18% off the YTD lows. Recently breaking through the bearish trend line since YTD highs, and with both MACD and RSI bullish, the focus is on a continuation higher near-term with 6777.45 the next upside level to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.