Institutional Insights: Goldman Sachs - Tactical Flow of Funds: August

Institutional Insights: Goldman Sachs - Tactical Flow of Funds: August

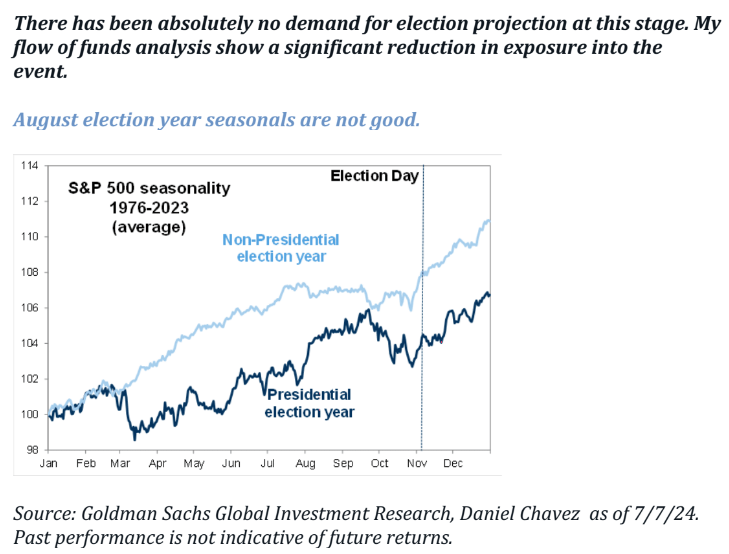

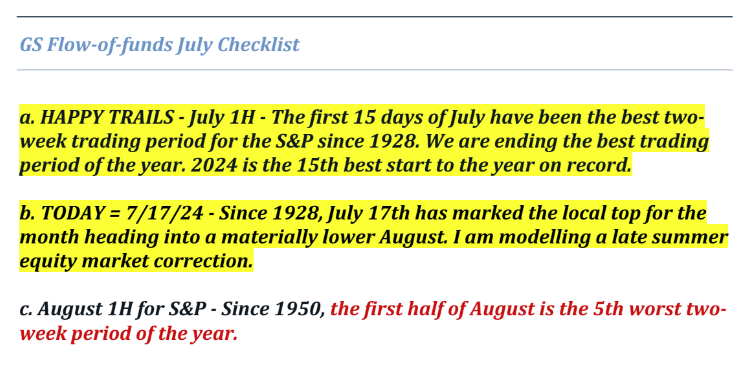

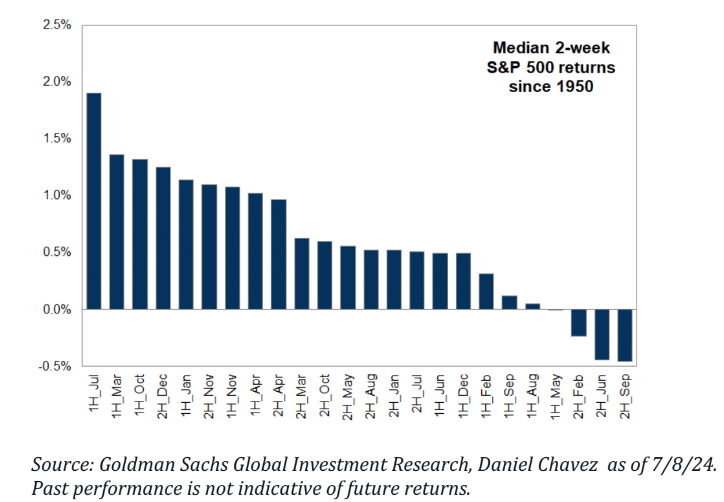

According to Goldman Sachs flow expert Scott Rubner "July 17 typically marks the end of summer BBQ / pool / pirate themed party, for the S&P 500 since 1928. The S&P has hit 38 new all time highs, on pace for the 2nd most closing highs in ~100 years, only 1995 is shaping up to be stronger. Blow off top completed (up 13 in 15 sessions), summer slipper engaged. The pain trade is no longer higher from here. I am not buying the dip. July, Friday, option expiration is a good barometer to unclench this massive dealer long gamma position and the market will be able to move more freely into lower trading liquidity and vacations starting next week. As for positioning nearly every one of my charts is at max length. You can pick through a super specific line item such as “HF trimmed M7 tech” but with 2% of the total assets under manage, that is missing the larger household concentration (>50%) that just deployed the second largest passive inflows on record (only to 2021). August is the month for the largest equity outflows. It is clear to me that the passive inflows have slowed, watch market on close imbalances, the market on close imbalance was $8B for sale in the last 3 days. Trade ideas available: (I like NDX and SPX December Lookback put options). There has been a rotation, but not a de -gross thus far, this changes when both factors move lower"

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!