Inflation Rises Below Forecasts

The British Pound has come back under fresh selling pressure today as traders react to the latest UK inflation data. Annualised CPI was seen rising 2.2% last month, up from the prior month’s 2% reading but below the 2.3% the market was looking for. Additionally, services inflation was seen falling sharply to 5.2% from 5.7% prior, below both the market forecast of 5.5% and the BOE forecast of 5.6%. The BOE had previously noted that stickiness in services inflation was one of the big roadblocks for easing. With this component dropping sharply, September rate cut chances look a little better, despite the uptick on headline inflation.

Better Jobs Data

The data comes fresh on the heels of yesterday’s jobs market data which showed the unemployment rate falling to 4.2% from 4.4% prior. The reading saw GBP rallying as traders mulled whether stronger UK economic activity would lead to a slower pace of easing from the BOE. In light of today’s inflation data, traders will now be looking for clarity from BOE governor Bailey when he speaks at the Jackson Hole Symposium next week. Expectations for a September cut are currently in the balance with market pricing sitting just below 50%. As such, there is plenty of room for Bailey’s comments to drive expectations one way or the other, lining up heavy two-way risk in Sterling next week.

Technical Views

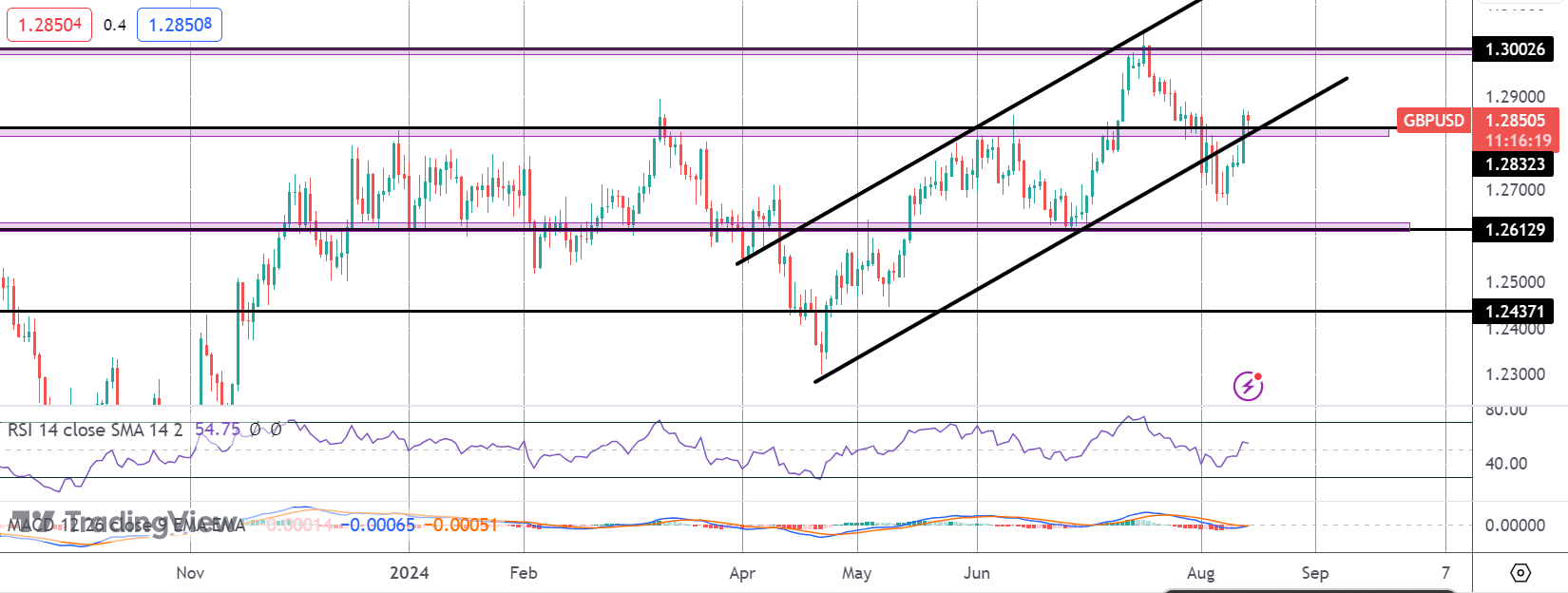

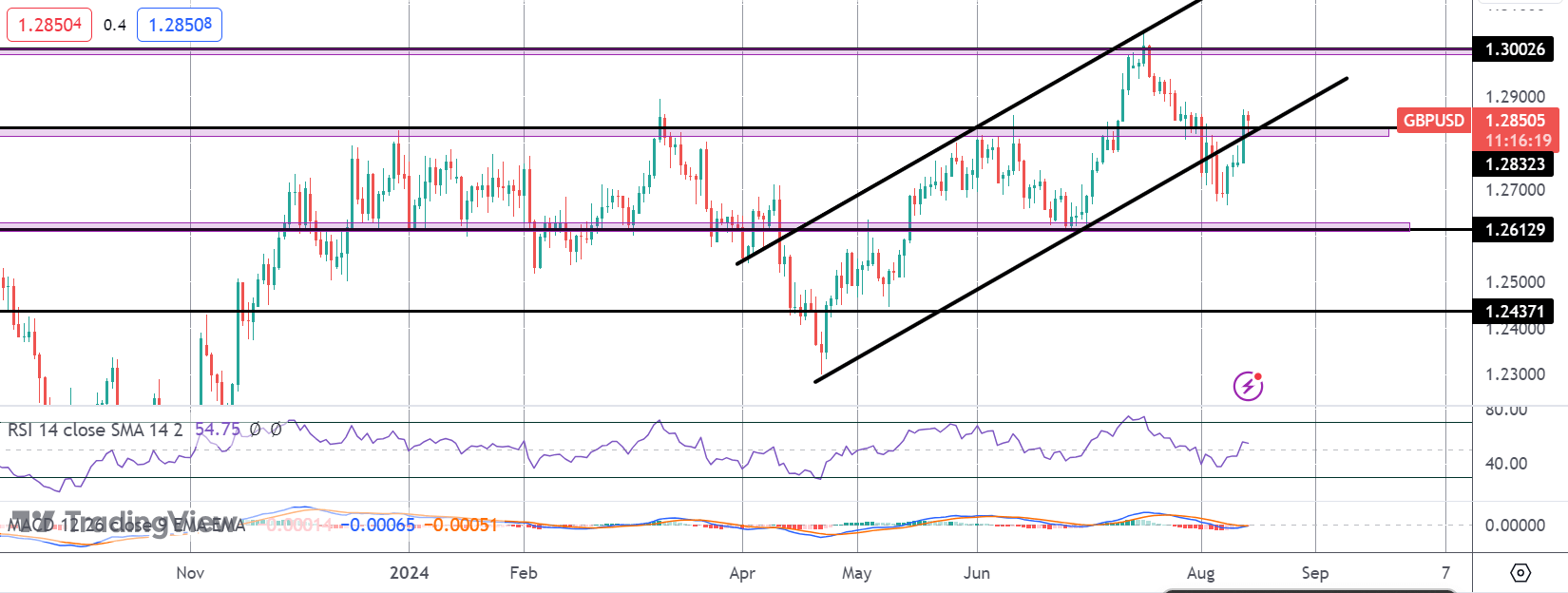

GBPUSD

The rally in GBP has seen the market breaking back above the 1.2832 level and back inside the bull channel. While above 1.2832 and with momentum studies turning higher focus is on a continuation higher with 1.30 the next objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.