Euro Slides As ECB Signals June Rate Cut Chances

June Cut in Focus

Yesterday’s ECB meeting was a pivotal moment for FX traders with the bank essentially giving the nod for a June rate cut. Monetary policy was held unchanged yesterday, as expected. However, Lagarde noted that the ECB continued to make good progress towards achieving its inflation target but wanted more confirmation that it had been achieved. Looking ahead, Lagarde noted that it would likely have enough evidence in three months’ time, for the June meeting.

Growth Forecasts Cut Again

Alongside the verbal guidance offered, traders also noted downward revisions to the bank’s growth and inflation forecasts. Indeed, this marks the fourth consecutive quarterly reduction in its growth forecast with eurozone GDP now projected to hit just 0.6% this year, down from 0.8% in December. Another crucial detail of the meeting was Lagarde noting that the ECB won’t necessarily wait until CPI is at its target before easing, a clear shift away from prior guidance offered.

Easing Expectations

With the ECB now clearly moving towards easing, the big question for traders is how quick and how deep the bank is likely to cut. Given that services inflation and wage growth remain sticky in the eurozone, the bank is likely to trade carefully in removing easing. However, if these factors start to shift, that could open the door to much heavier rates cutting, leading EUR lower near-term.

Technical Views

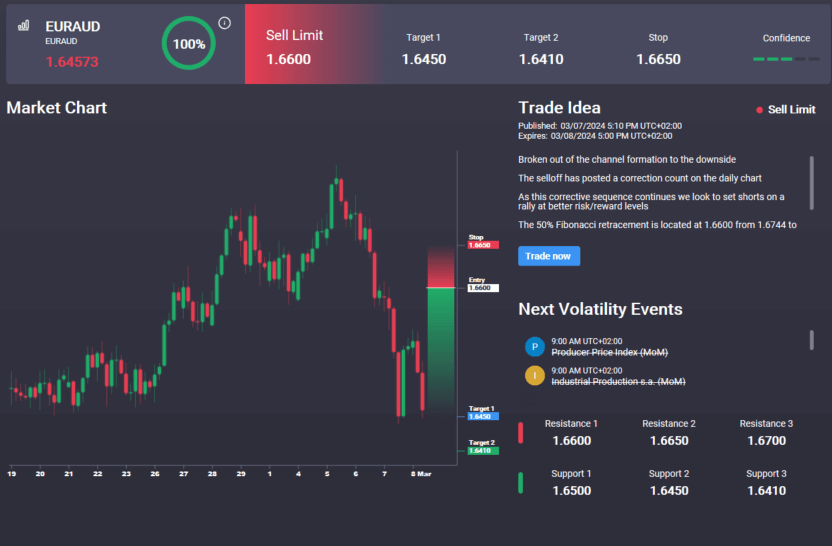

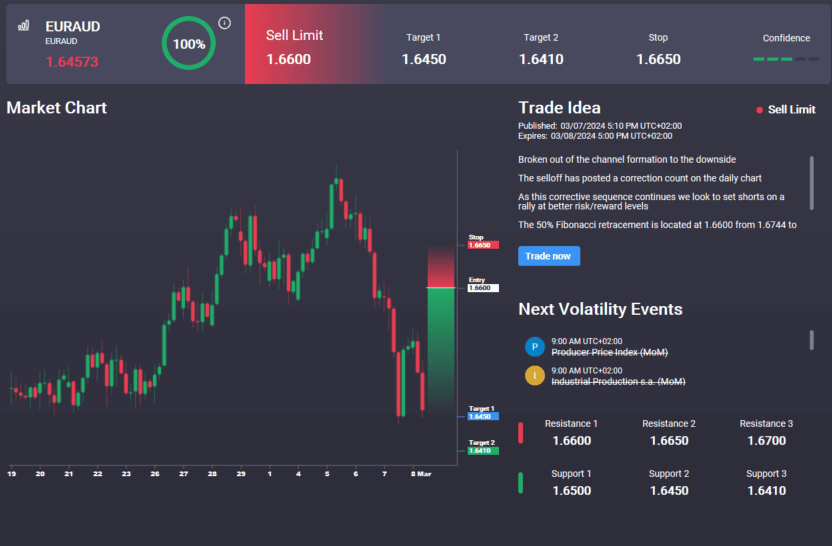

EURAUD

The rally has faded ahead of a test of the 1.6829 level with price now trading back inside the bear channel, having broken through the bull trend line off YTD lows. Price is now sitting on key support at the 1.6461 level. With momentum studies bearish, risks of a break lower are growing with 1.6249 the next target for bears should we drop from here. Notably, we have a sell signal in the Signal Centre today set at 1.6650 suggesting a preference to fade any move higher and stay short.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.