Daily Market Outlook, July 07, 2023

Daily Market Outlook, July 07, 2023

Munnelly’s Market Commentary…

Asian equity markets lower as global markets experienced selling pressure driven by declines on Wall Street. The Nikkei 225 opened with a slump following disappointing Household Spending data, although it later recovered some of its losses. The Hang Seng and Shanghai Comp. were also in negative territory due to growth concerns and ongoing trade frictions with the US.

According to building society Halifax, house prices in the UK experienced a slight decline of -0.1% in June. The data indicates that the housing market stabilised during the month, with a consistent number of mortgage applications, especially from first-time buyers. However, the rising costs of borrowing and concerns about inflation have led to higher mortgage rates, which could affect affordability and potentially dampen demand in the future. Existing mortgage holders may also face rate increases as a result. These factors contribute to a more cautious outlook for the housing market going forward.

In the Eurozone German industrial production figures released earlier showed a third consecutive monthly decline, indicating a slowdown in manufacturing activity.There are no major economic releases on the docket, but market participants will pay attention to speeches from ECB officials including Vice President Guindos along with the head of the Bundesbank Nagel.

Stateside the focus of the day was on the monthly US labour market report, which will provide insights into the likelihood of the Federal Reserve resuming interest rate increases later in July. Expectations are for the US economy to have added 225k jobs in June, with a decline in the unemployment rate to 3.6%. However, in June, labour market indicators presented a mixed picture. Initial jobless claims showed a significant increase during the survey week, with the four-week moving average also trending higher. The employment sub-indices within S&P Global's flash PMI data eased but remained above the 50-mark, indicating expansion. The ISM manufacturing data revealed a contraction in employment, while the services gauge showed an increase in the employment index, indicating expansion. ADP's measure of payroll growth saw a notable increase, while Challenger Layoff numbers decreased. Currently, market expectations point to a potential interest rate hike by the Federal Reserve in July, and it is presumed that only a substantial miss in data, coupled with weakness in other indicators, would cause a rapid repricing in the market. Robust economic data this week have led to a lifting in market expectations for the Fed's terminal rate, which is now anticipated to reach 5.45% by November 2023.

CFTC Data As Of 30-06-23

USD IMM net spec short in the Jun 21-27 reporting period; $IDX -0.02%

EUR$ +0.38% in period, specs stayed on sidelines +379 contracts now +145,028

$JPY rose 1.91%, specs -5,214 contracts now -112,870 as BoJ remains steady

Recent test of 145, tipped intervention area may stir long profit-taking

GBP$ -0.1%, specs +5,386 contracts now +51,994 on rising UK rate view

BTC rose 8.86%, specs sold 2,491 contracts into strength, flip to -2,094

$CAD -0.31% in period, specs +30,696 contracts short pared to -2,847

AUD$ -1.49% in period, specs +10,192 contracts now -39,424

BoC, RBA had been considering further rate hikes amid persistent inflation

Inflation stalling has weakened CAD and AUD since Jun 21, may see recent longs lighten(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (854M),1.0850 (1.1BLN), 1.0880 (454M), 1.0900 (1.3BLN)

1.0920-25 (918M), 1.0970 (1BLN), 1.1000 (2.2BLN), 1.1010-15 (1.1BLN)

GBP/USD: 1.2625-35 (351M), 1.2825 (478M)

EUR/GBP: 0.8600 (265M), 0.8620 (217M)

AUD/USD: 0.6600 (500M), 0.6690 (331M), 0.6700 (1.5BLN)

USD/JPY: 143.00 (532M), 144.00 (359M), 145.00 (1.3BLN)

EUR/NOK: 11.70 (524M)

USD/CAD: 1.3300 (1.5BLN), 1.3350 (400M), 1.3400 (488M)

Overnight News of Note

Shares Fall In Asia After Treasury Yields Spike

US Renews Audit Inspection Of China Firms As Tensions Mount

BoJ Deputy Governor Uchida Vows To Keep Yield Control For Now

Japan's Wage Growth Doubles Estimates, Feeding BoJ Speculation

Japan Ex Vice FinMin Japan’s Currency May Weaken To 160 And Beyond

Market Surveys Show Wall Street Expected Less Hawkish Fed Outlook

ECB's Lagarde: We Still Have Work To Do To Bring Infl Back To Target

EU Paves Way To Quit International Accord On Energy Investments

Chinese State Media Says Yuan To Be Defended If Necessary

Crypto Trading Volume Dropped In Second Quarter To Lowest Since 2019

Oil On Track For Second Straight Weekly Gain On Resilient Demand

Shares Fall In Asia After Strong US Data Sent Treasury Yields Higher

Twitter Sends Meta Cease-And-Desist Letter Over New Threads App

AbbVie Trims Full-year Profit Forecast On Higher R&D Expenses

Tesla Starts To Lay Off Some Battery Workers At China Factory

Electric Car Sales Growth Slows In US As Inventory Builds Up

US FDA Grants Standard Approval Of Eisai/Biogen Alzheimer's Drug

Samsung Profit Beats As Memory Chip Sector Recovers From Trough

China To End Ant Group's Regulatory Revamp With Fine Of At Least $1.1Bln

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

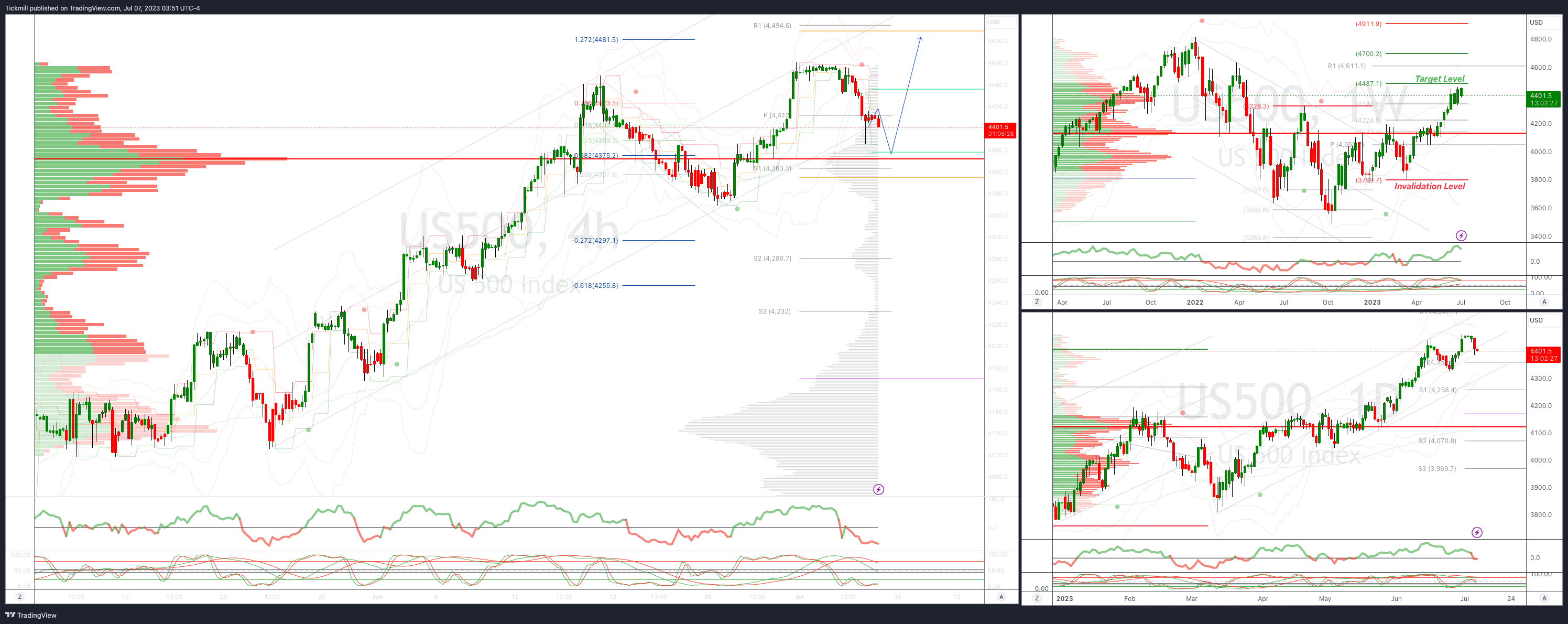

SP500 Bias: Intraday Bullish Above Bearish Below 4412

Below 4400 opens 4370

Primary support is 4300

Primary objective is 4540

20 Day VWAP bullish, 5 Day VWAP bearish

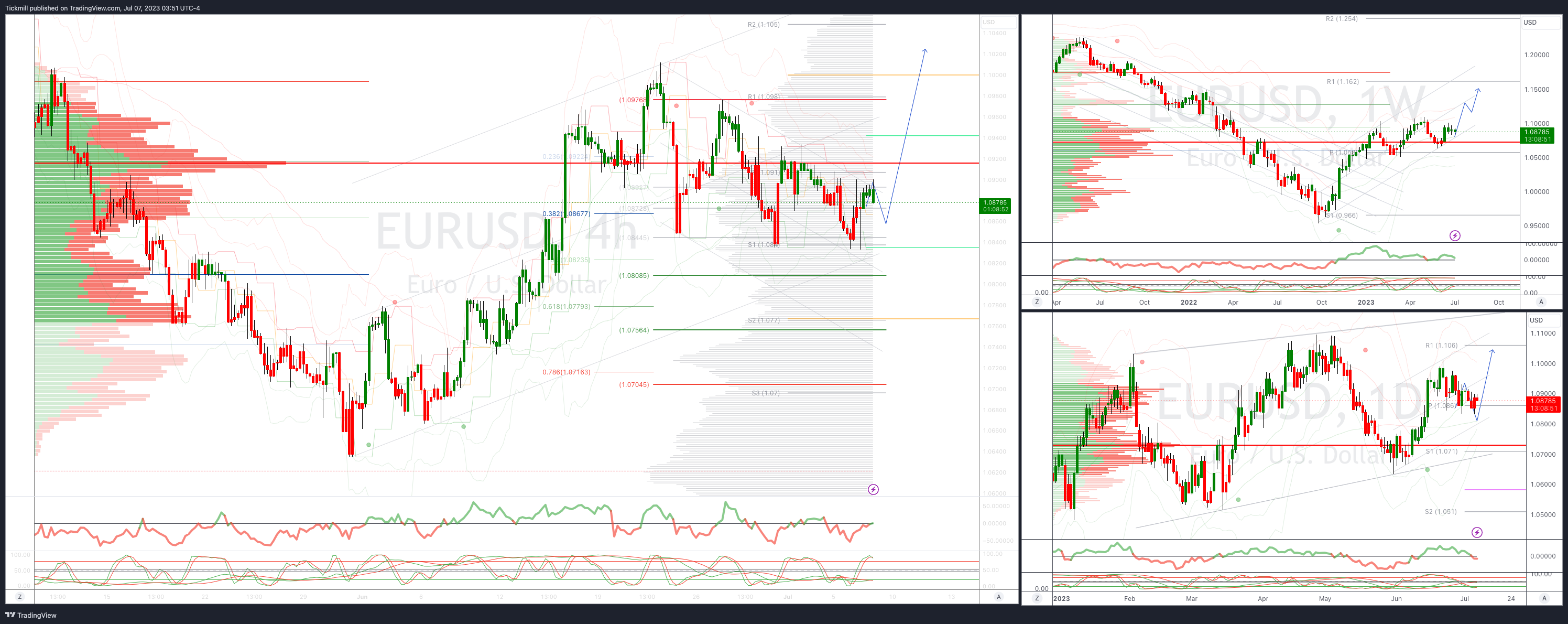

EURUSD Intraday Bullish Above Bearsih Below 1.0840

Below 1.0840 opens 1.08

Primary support is 1.07

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

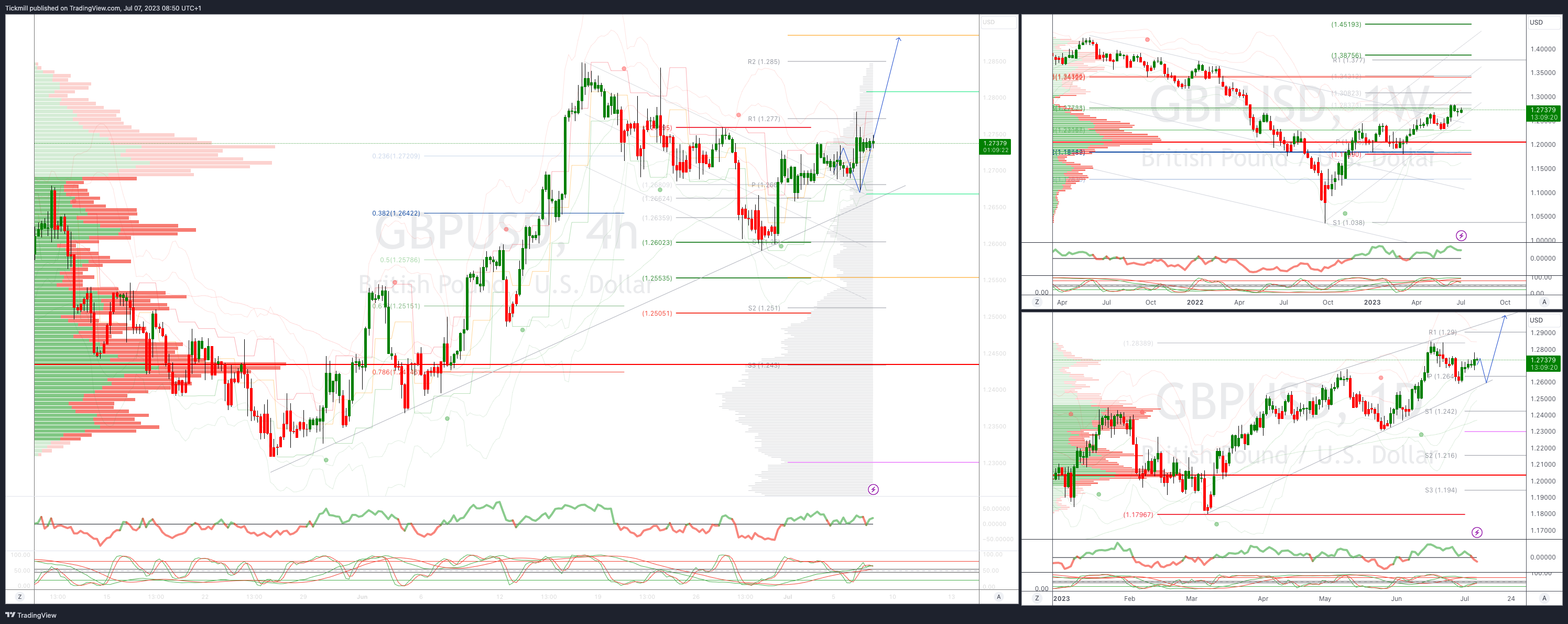

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2650

Below 1.26 opens 1.2550

Primary support is 1.26

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bullish

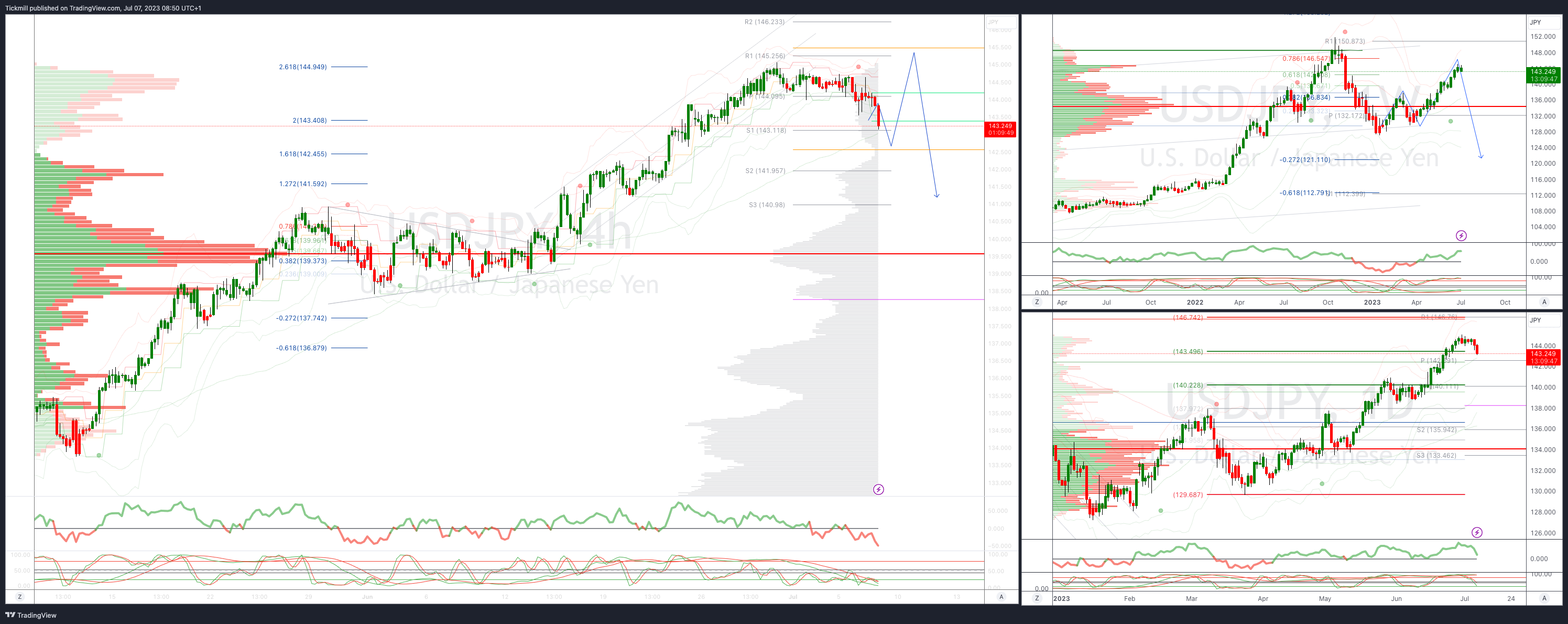

USDJPY Bullish Above Bearish Below 143.50

Below 143 opens 142.30

Primary support is 141

Primary objective is 145.50

20 Day VWAP bullish, 5 Day VWAP bearish

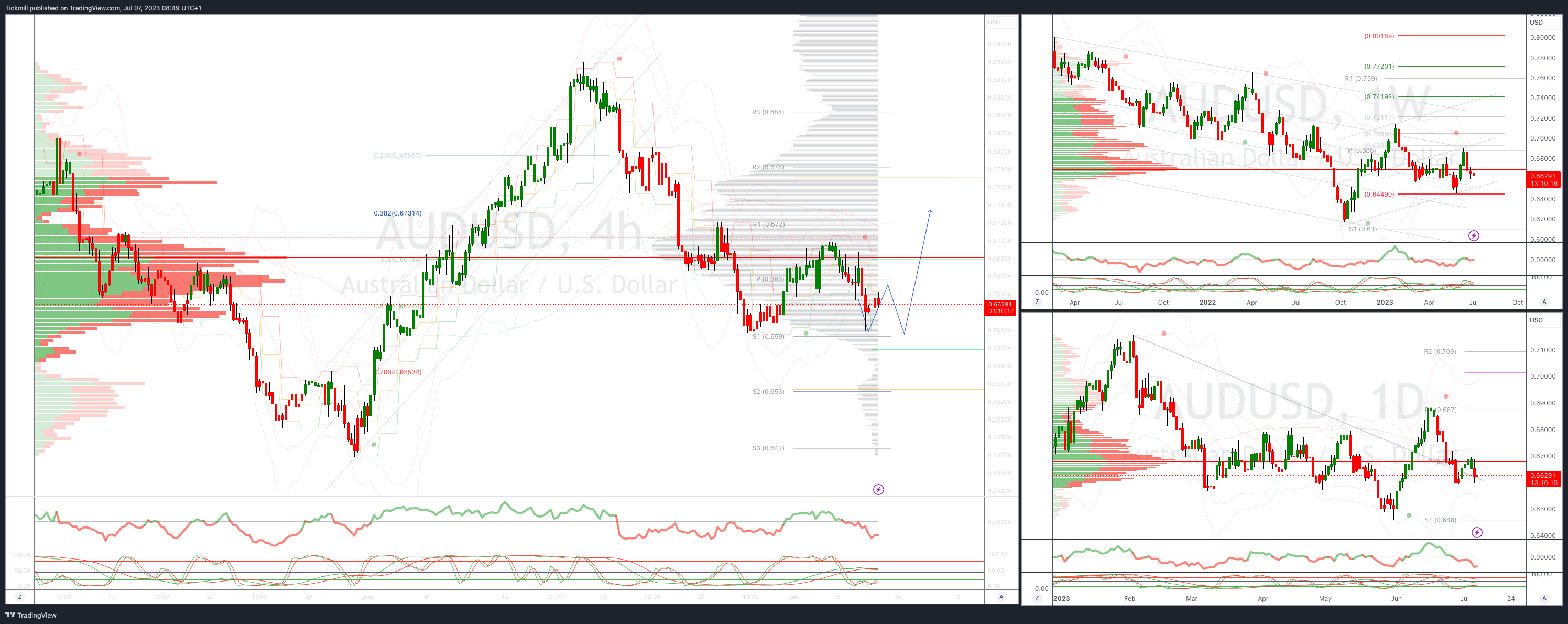

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bullish

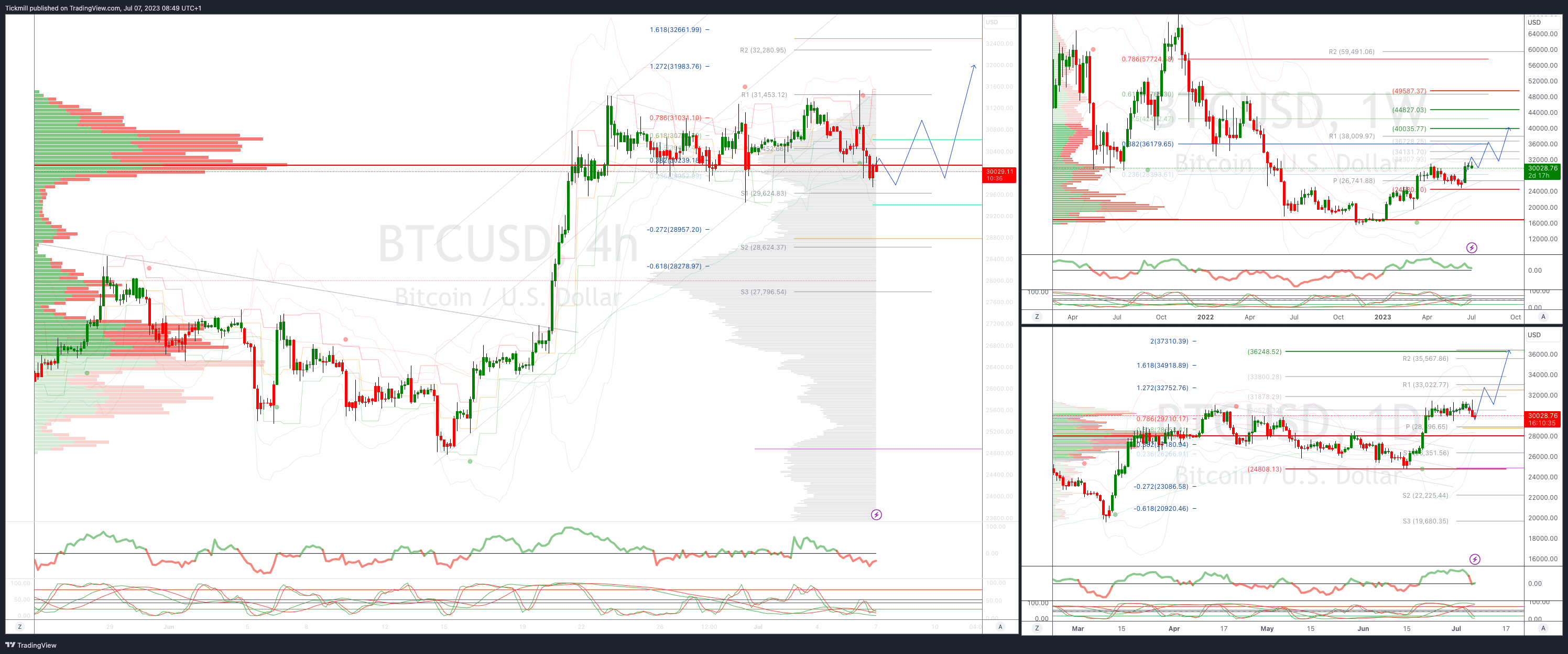

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!