Daily Market Outlook, July 05, 2023

Daily Market Outlook, July 05, 2023

Munnelly’s Market Commentary…

Asian equity markets faced downward pressure as market participants digested the latest Chinese Caixin Services PMI data and ongoing geopolitical concerns. Nikkei 225 initially slumped but recovered slightly after holding above the 33k handle. Hang Seng and Shanghai Comp. remained subdued due to trade-related frictions and warnings of potential retaliatory measures against Western tech export controls. The Chinese Caixin Services PMI came in below forecasts, signalling the slowest pace of increase since January.

With US markets back from the holiday, attention turns to the Federal Reserve's potential interest rate hike at the next monetary policy update. The minutes of the Fed's June meeting, where interest rates were left unchanged, may provide some clues. Fed Chair Powell has indicated that the pause should be seen as a temporary break, and a majority of policymakers believe two more rate hikes may be necessary this year. Market expectations currently suggest an 85% probability of a rate hike on July 26th, but there is more scepticism about additional hikes afterward. While not much new information is expected from the minutes, the discussion details may shed light on the reasons behind the pause. Market participants will also be keen to identify the factors policymakers will consider when deciding on a potential July rate hike.

On the economic data docket, the UK and Eurozone will release second readings of their June PMI services outturns. These readings are not expected to deviate from the initial estimates, which showed a slight loss of momentum but still solid services activity. Inflationary pressures were mixed, but labour market pressures remained intense in the UK.

In the US, May factory orders data will provide insights into manufacturing trends. Over the past year, orders have been trending downward, indicating similar pressures in the US manufacturing sector as in other regions. However, there are positive signs, such as a bounce in durable goods orders in May, driven partially by the volatile transport sector. Additionally, there are tentative indications that President Biden's "green" incentives are starting to impact capital goods orders.

CFTC Data As Of 30-06-23

USD IMM net spec short in the Jun 21-27 reporting period; $IDX -0.02%

EUR$ +0.38% in period, specs stayed on sidelines +379 contracts now +145,028

$JPY rose 1.91%, specs -5,214 contracts now -112,870 as BoJ remains steady

Recent test of 145, tipped intervention area may stir long profit-taking

GBP$ -0.1%, specs +5,386 contracts now +51,994 on rising UK rate view

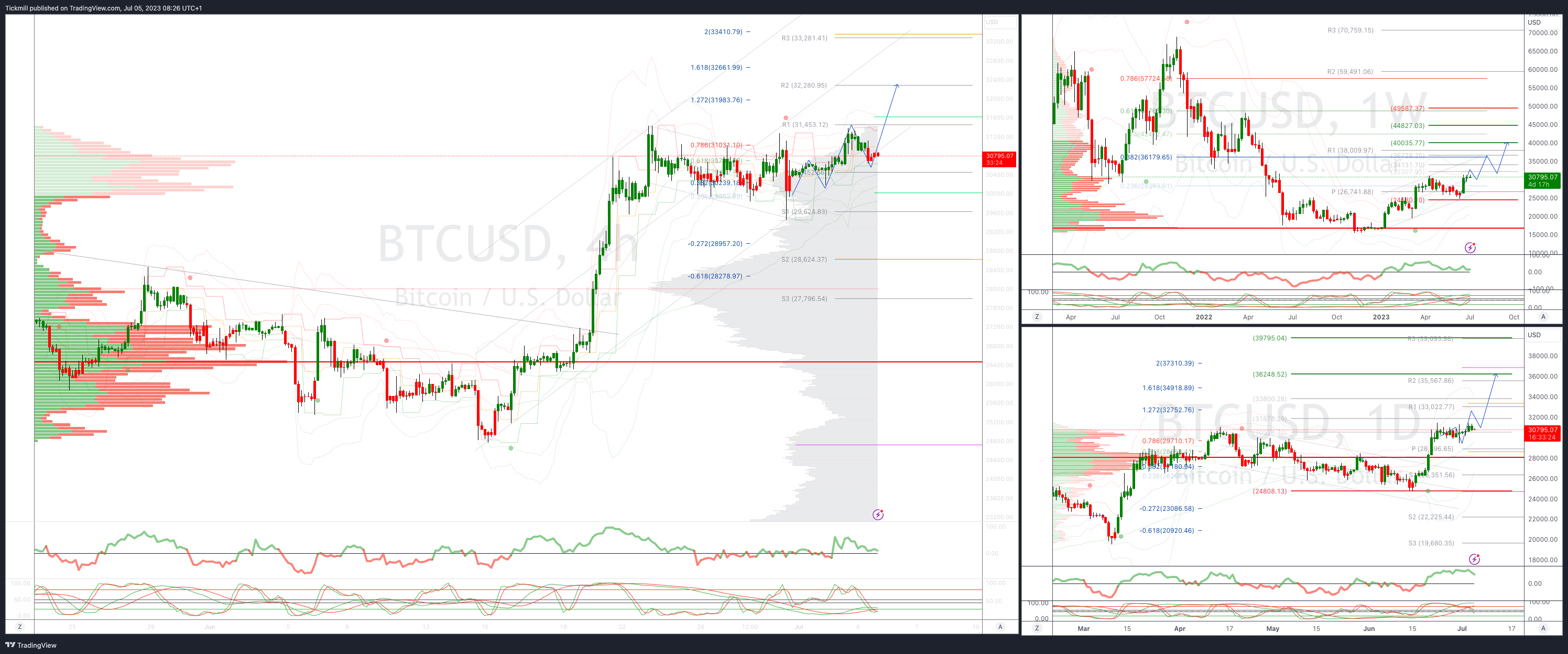

BTC rose 8.86%, specs sold 2,491 contracts into strength, flip to -2,094

$CAD -0.31% in period, specs +30,696 contracts short pared to -2,847

AUD$ -1.49% in period, specs +10,192 contracts now -39,424

BoC, RBA had been considering further rate hikes amid persistent inflation

Inflation stalling has weakened CAD and AUD since Jun 21, may see recent longs lighten(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0835-50 (701M), 1.0900 (2.7BLN), 1.0950 (385M), 1.1000 (1.5BLN)

USD/CHF: 0.9100 (400M)

GBP/USD: 1.2530 (736M), 1.2565 (466M), 1.2575 (687M)

EUR/GBP: 0.8625 (354M), 0.8700 (462M)

USD/JPY: 144.50 (230M), 145.00 (220M), 145.25 (680M)

EUR/NOK: 11.50 (600M)

Overnight News of Note

Asian Shares Fall On Growth Concerns, Focus Shifts To Fed Minutes

Caixin PMI: China's Services Activity Softens As Recovery Falters

China Ex Vice-Min Of Commerce: Chip Materials Export Controls Just A Start

Japan Labour Confederation Sees Biggest Average Wage Hike Since 1993

NZ Govt Debt Now NZ$5B Above Budget Fcst As Accounts Disappoint

Bank Of England Considers Clampdown On Foreign Bank Branches

Russia, Ukraine Accuse Each Other Of Plotting Attack On Nuclear Plant

Brazil Senate Committee Approves Lula's Picks For Central Bank Board

Dollar Steady Before Fed Minutes; Yen Hovers Below Intervention Zone

Oil Drifts Lower As Traders Take Stock Of OPEC+ Supply Curbs

Asian Shares Fall On Growth Concerns, Focus Shifts To Fed Minutes

Investors Slash Outlook For Asia Stocks On Fading China Optimism

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

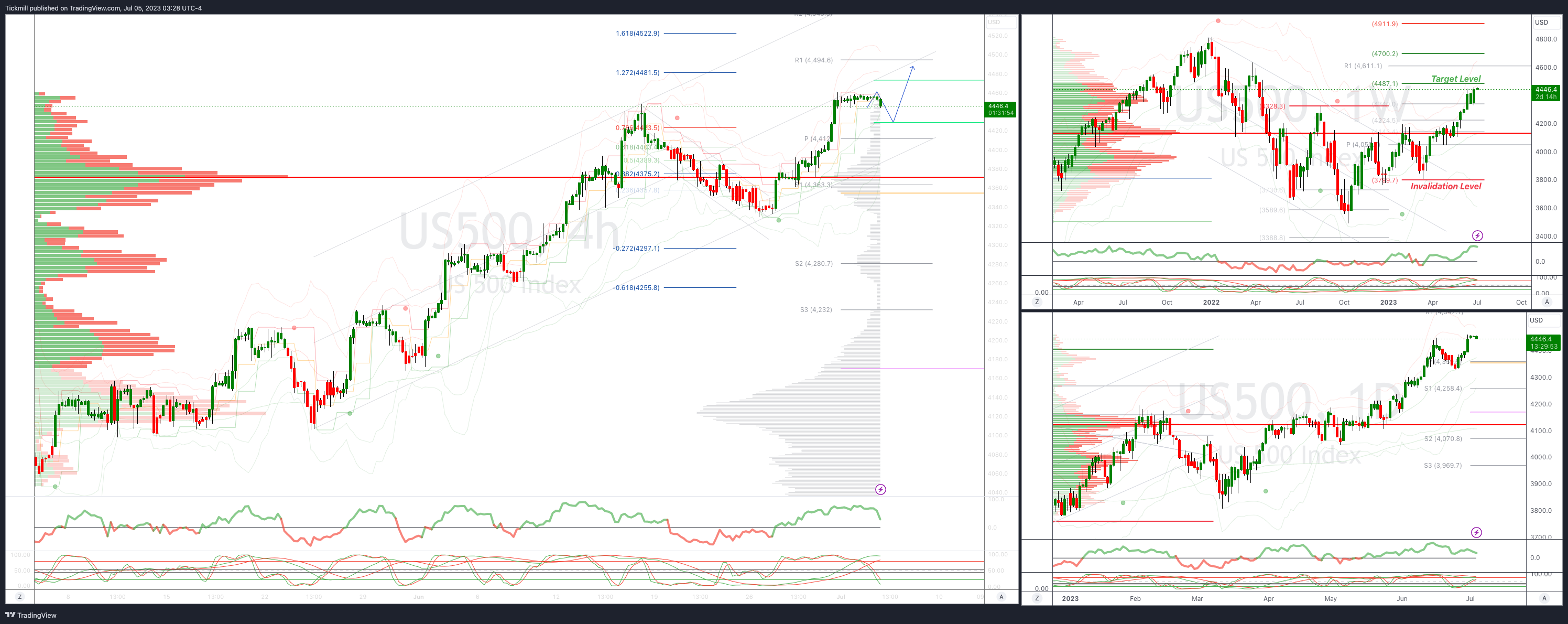

SP500 Bias: Intraday Bullish Above Bearish Below 4412

Below 4400 opens 4370

Primary support is 4300

Primary objective is 4540

20 Day VWAP bullish, 5 Day VWAP bullish

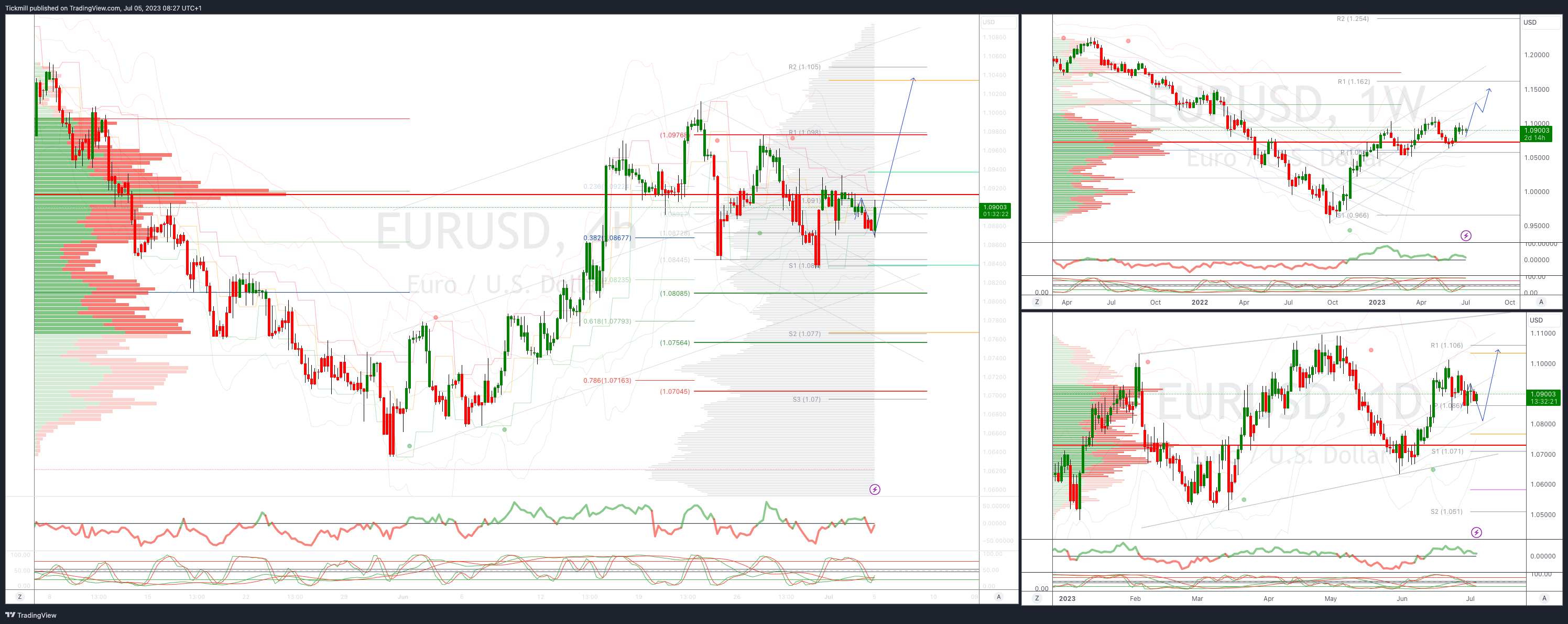

EURUSD Intraday Bullish Above Bearsih Below 1.0840

Below 1.0840 opens 1.08

Primary support is 1.07

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

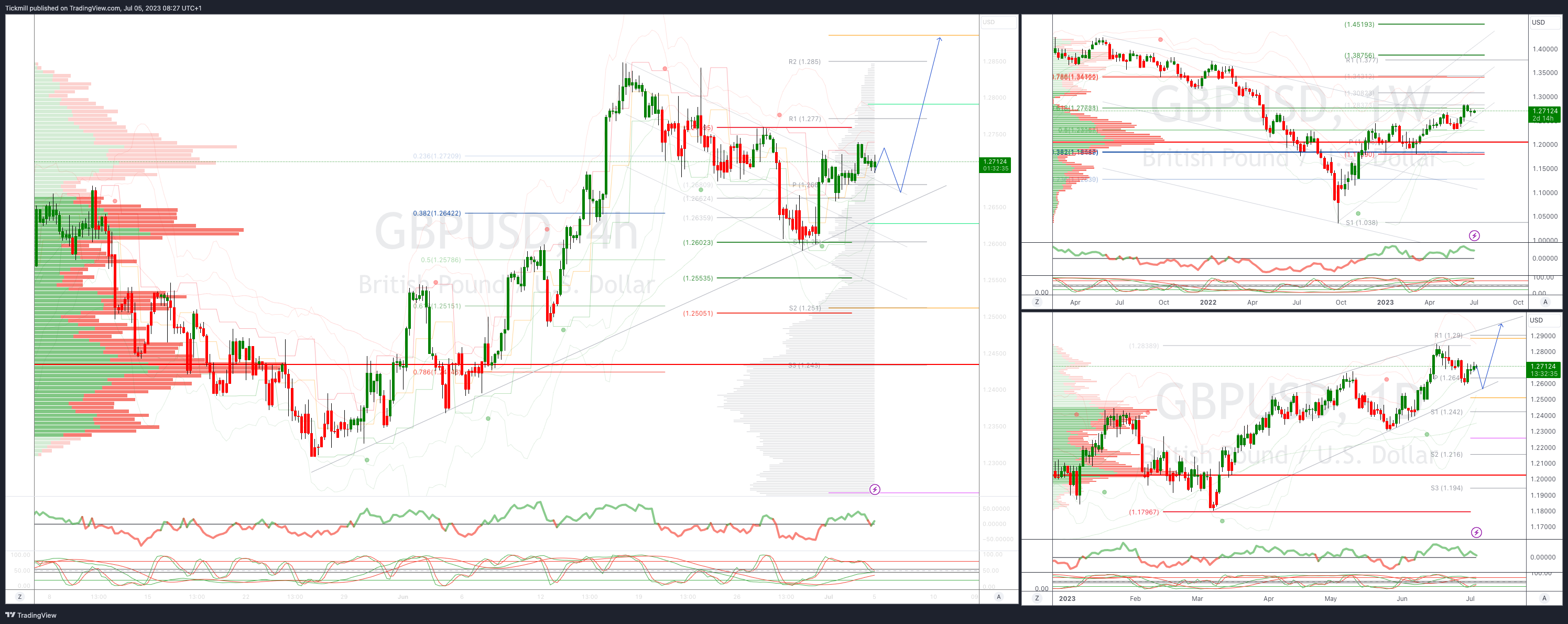

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2650

Below 1.26 opens 1.2550

Primary support is 1.26

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bullish

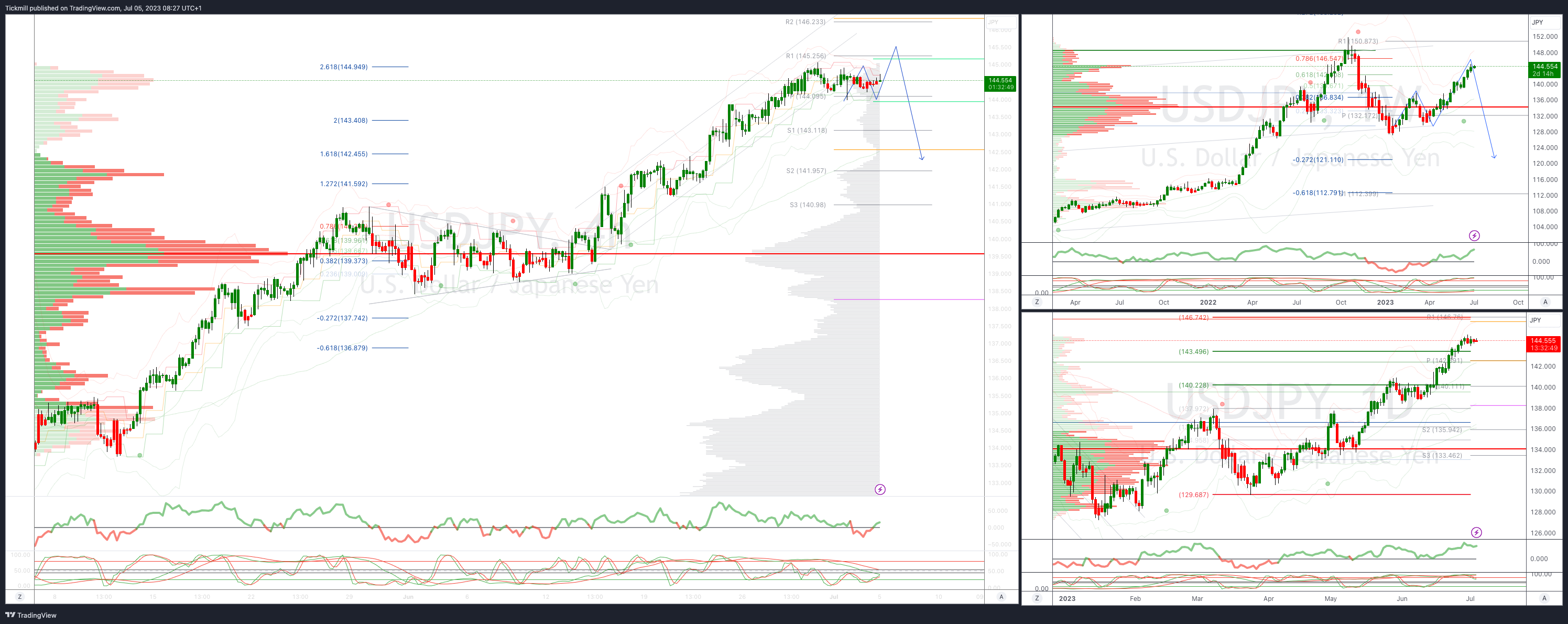

USDJPY Bullish Above Bearish Below 143.50

Below 143 opens 142.30

Primary support is 141

Primary objective is 145.50

20 Day VWAP bullish, 5 Day VWAP bullish

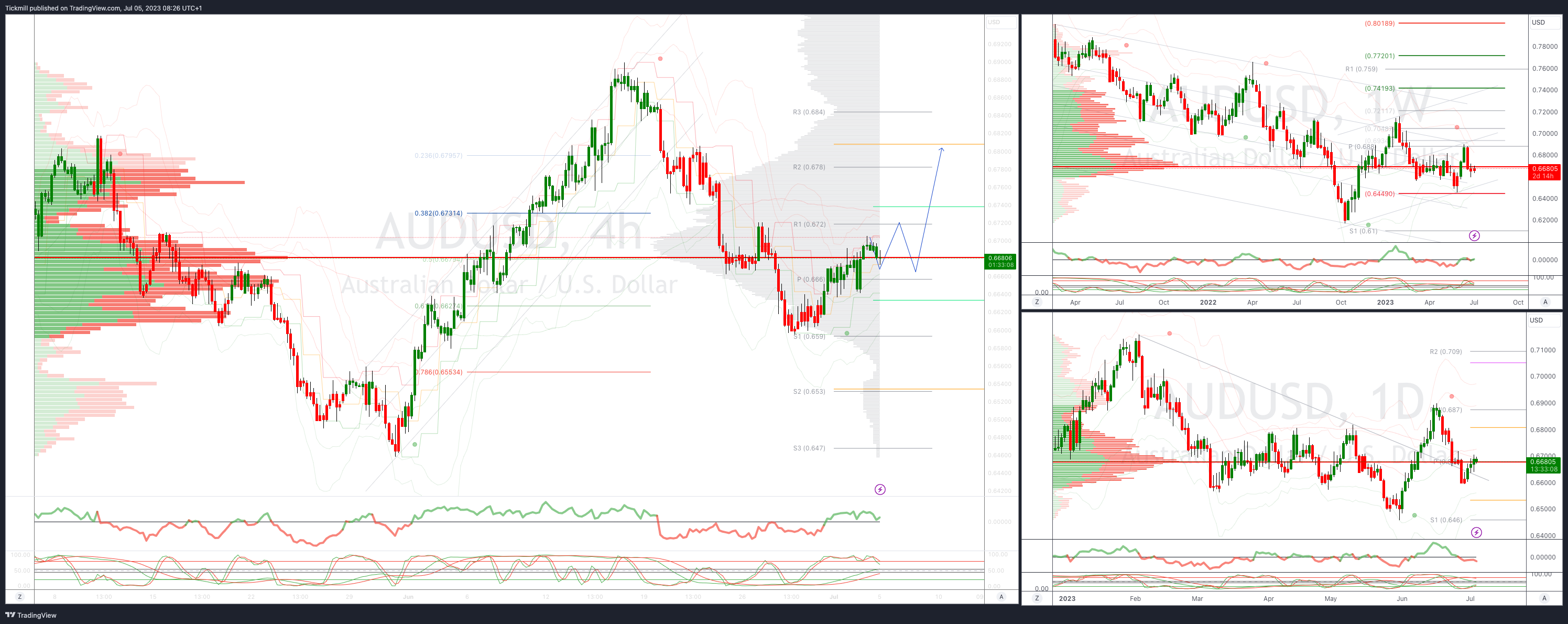

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!