REAL TIME NEWS

Loading...

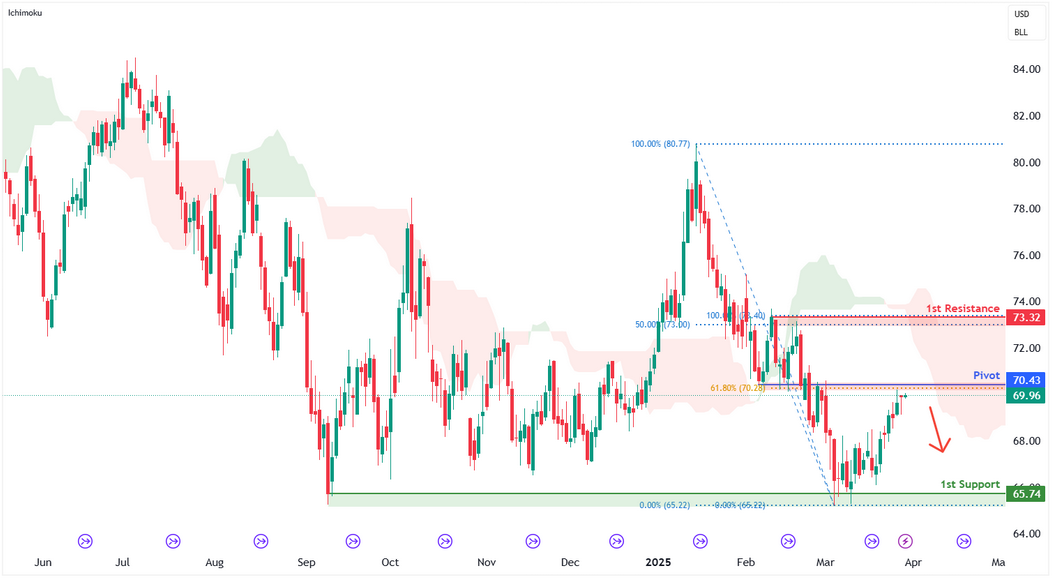

Fed Rate-CheckUSDJPY remains weak today, gapping lower at the open, on the back of heavy selling on Friday in response to the Fed rate-check activity. News started coming through around the London close on Friday that the Fed was asking banks in New York about thei...

Fed Rate-CheckUSDJPY remains weak today, gapping lower at the open, on the back of heavy selling on Friday in response to the Fed rate-check activity.

Main driver: JPY “rate checks” and signaling risk around potential intervention (possibly coordinated Japan/US) is the dominant theme; spillover is broad USD weakness.USD bias: Staying short USD, framed as an “enduring” structural story driven by:repeated pension-f...

Main driver: JPY “rate checks” and signaling risk around potential intervention (possibly coordinated Japan/US) is the dominant theme; spillover is br

FTSE 100 FINISH LINE 26/1/26 London's stock market kicked off the week on a quiet note this Monday, as gains in metal mining stocks helped balance out losses in industrial sectors. The FTSE 100 blue-chip index and the mid-cap FTSE 250 index saw little movement...

FTSE 100 FINISH LINE 26/1/26 London's stock market kicked off the week on a quiet note this Monday, as gains in metal mining stocks helped balanc

What’s Driving Bitcoin?Bitcoin prices are bouncing back today from fresh YTD lows after the futures market gapped lower at the open, extending Friday’s sell-off. BTC remain down sharply from the initial January highs which now amount a false range-break and signal ...

What’s Driving Bitcoin?Bitcoin prices are bouncing back today from fresh YTD lows after the futures market gapped lower at the open, extending Friday’

Daily Market Outlook, January 26, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…U.S. stocks wrapped up a turbulent week with the S&P 500 marking its first back-to-back weekly decline since June, despite rebounding from e...

Daily Market Outlook, January 26, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…U.S. stocks wrapped up a turb

Inflows To Cyclicals SurgeEquity positioning remains largely unchanged at the headline level, mirroring the S&P 500’s sideways movement despite several brief market disruptions (0.41 standard deviations, 68th percentile). Systematic strategies reduced their ove...

Inflows To Cyclicals SurgeEquity positioning remains largely unchanged at the headline level, mirroring the S&P 500’s sideways movement despite se

SP500 LDN TRADING UPDATE 26/1/26***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE******WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***WEEKLY BULL BEAR ZONE 6880/70WEEKLY RANGE RES 7065 SUP 6928FEB OPEX STRADDLE 6726/7154MAR ...

SP500 LDN TRADING UPDATE 26/1/26***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE******WEEKLY ACTION AREA VIDEO TO F

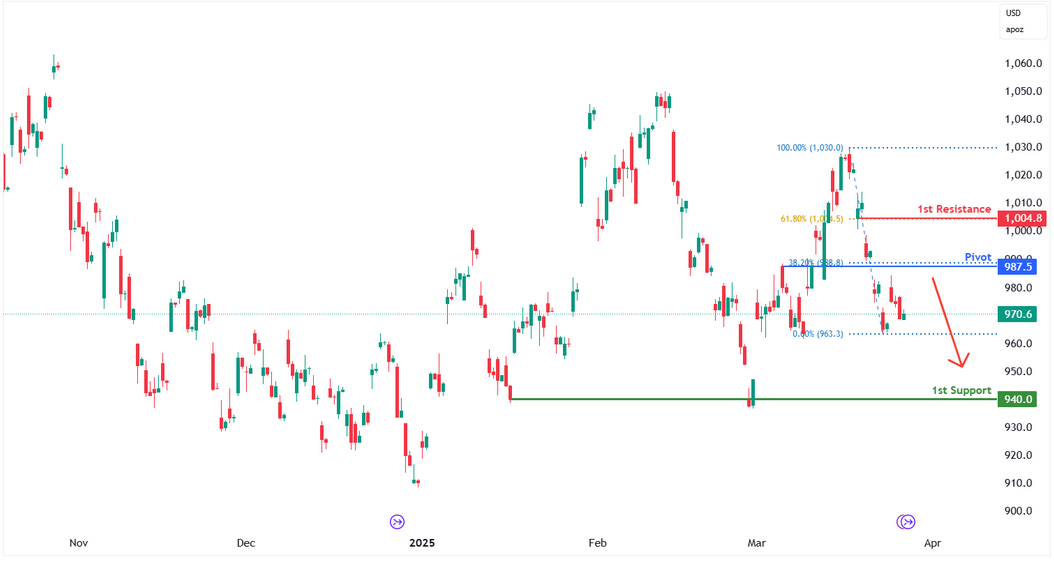

Gold Hits New Record HighsGold prices remain on watch this week with the futures market continuing to soar into fresh record highs. Price is now above the $5k level for the first time and shows no signs of slowing down as a firmly weaker USD and ongoing geopolitica...

Gold Hits New Record HighsGold prices remain on watch this week with the futures market continuing to soar into fresh record highs. Price is now above

SP500 Weekly Action Areas & Price TargetsReal-time actionable analysis on futures markets. specific focus on E-mini S&P 500. To review this week's analysis, click here!...

SP500 Weekly Action Areas & Price TargetsReal-time actionable analysis on futures markets. specific focus on E-mini S&P 500. To review this we

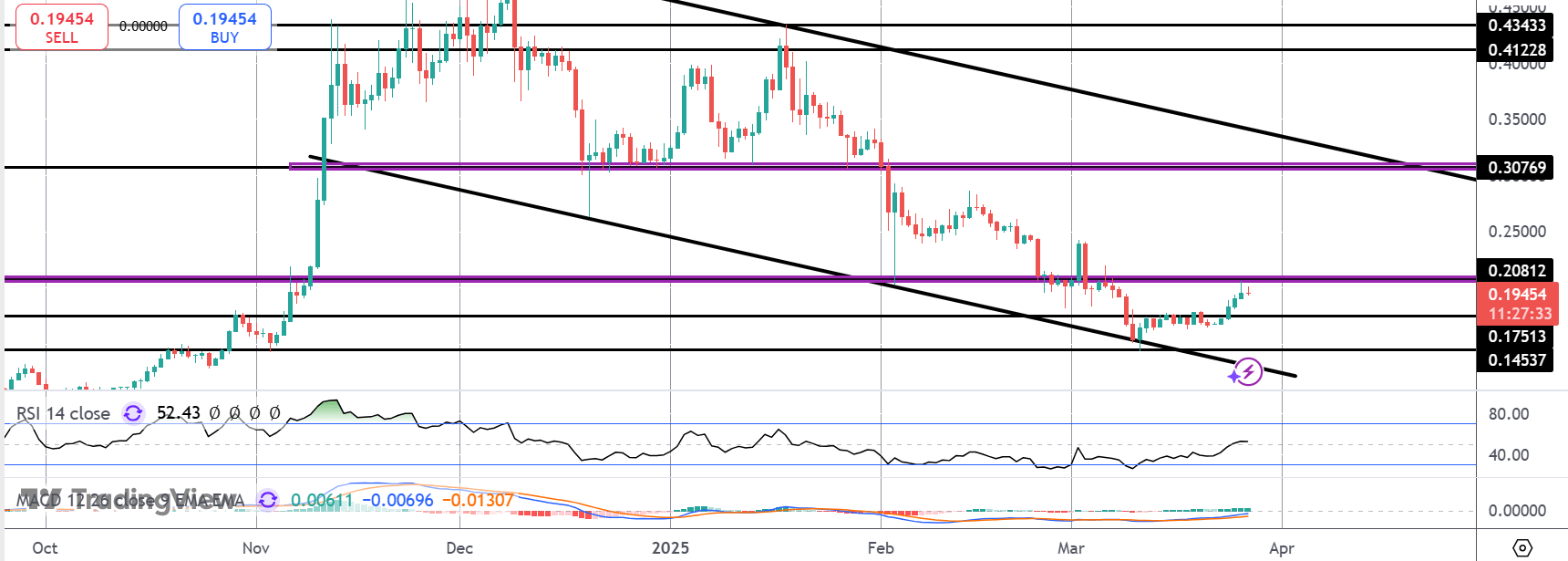

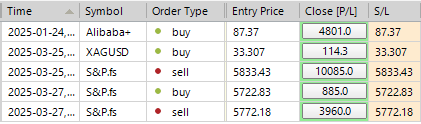

VWAP Swing Strategy Weekly Review & Weekly Setups 25/1/25In this update, we review last week's setups and strategy performance, as well as identify the weekly opportunity set for the week ahead. To review this week's video, click here!...

VWAP Swing Strategy Weekly Review & Weekly Setups 25/1/25In this update, we review last week's setups and strategy performance, as well as id

.jpeg)

.png)