Bitcoin Breaks Below $100k As ETF Outflows Soar

BTC Selling Deepens

It’s been a bad week for Bitcoin bulls. The leading crypto asset has seen heavy losses with the futures market shedding more than 10% from the weekly highs on Tuesday. Indeed, the market yesterday saw its first sub-$100k close since May, a worrying development for bulls.

BTC Defies Seasonal Expectations

Price is now down almost 25% from the record highs printed in early October and many are calling the start of a near market with furtehr losses now expected. This stands in stark contrast to where we were at the beginning of Q4 with price pushing higher and bullish forecasts aplenty. Much of this was premised on the seasonal view of BTC which has averaged returns of more than 85% in Q4 since 2013. Of course, we’re only half-way through the quarter but it would take a record reversal for BTC to end the quarter back in the green from here.

Risk Aversion Hurting Sentiment

In terms of what’s driving the sell-off, the picture is little murky. News of a US/China trade deal, the re-opening of the US govt following a record shutdown, and dovish Fed expectations should, on paper, be driving BTC higher here. However, the broader risk complex is looking fatigued with US stocks still down from highs also, reflecting investor uncertainty on the back of the shutdown. This echoes the large institutional outflows we’ve seen recently with BTC ETF’s losing almost $1 billion in capital this week as traders reallocate funds with gold the likely beneficiary given the heavy rally we’re seeing this week. While ETF outflows continue BTC looks poised for further losses near-term.

Technical Views

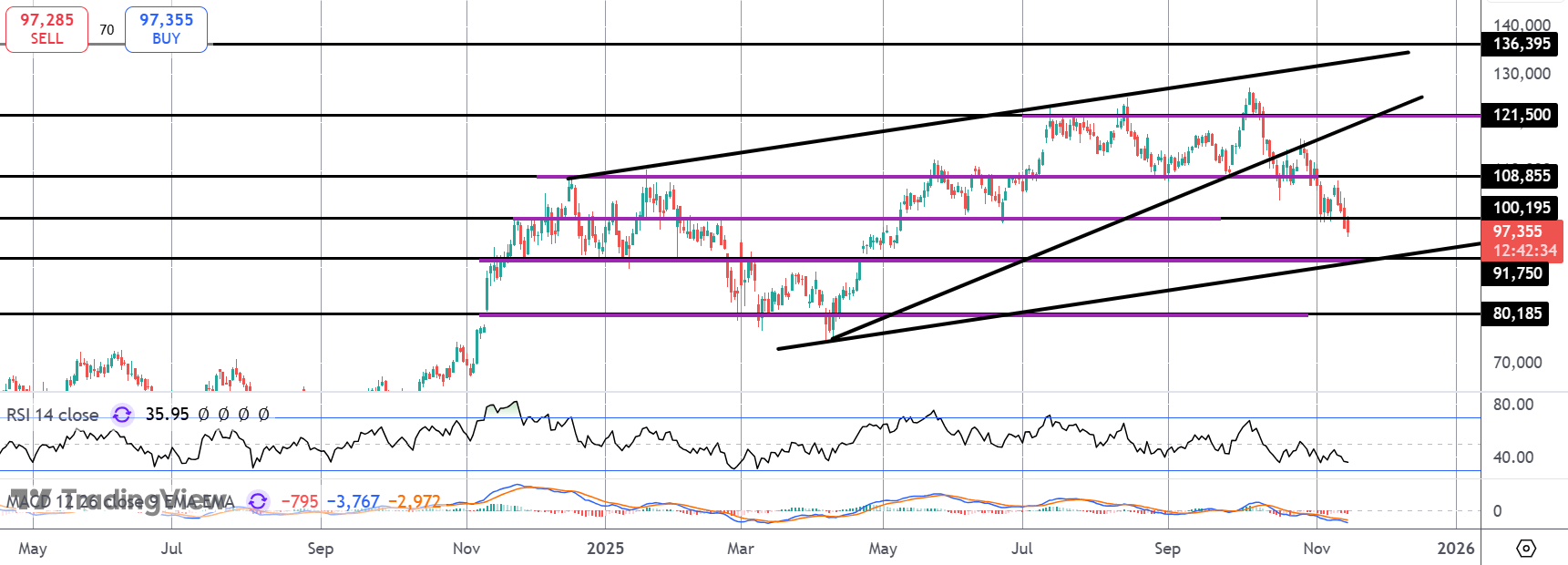

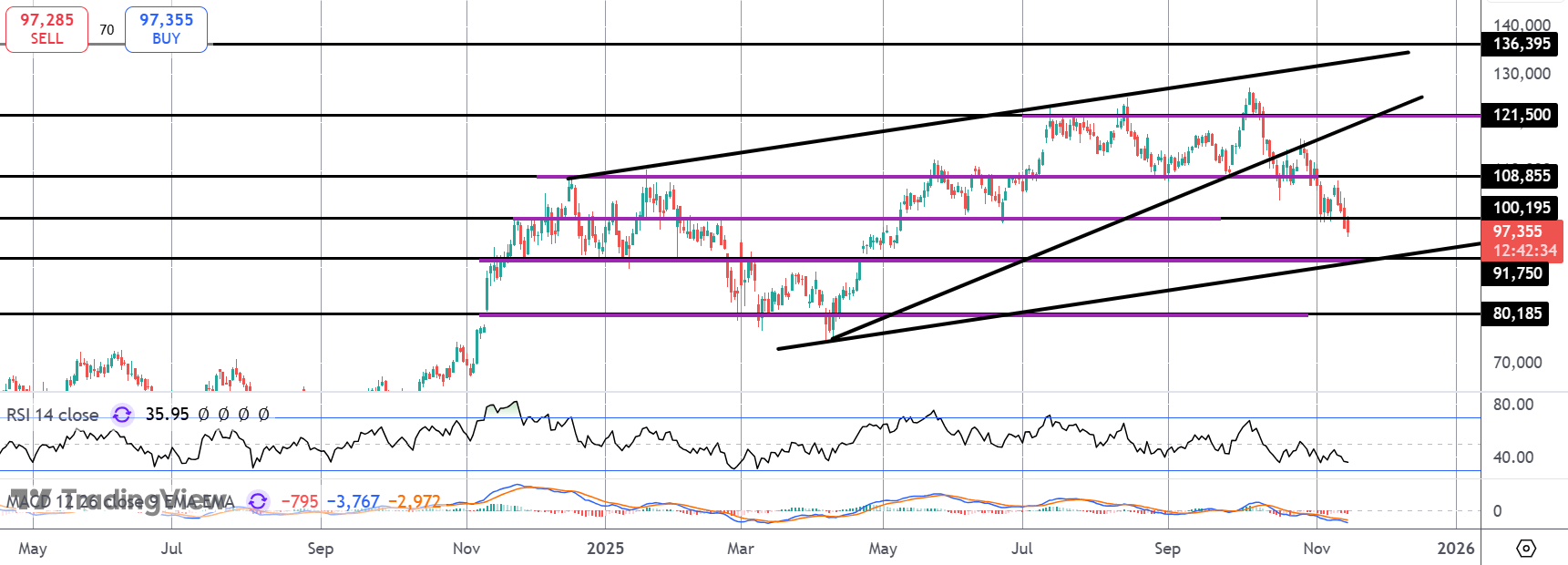

BTC

Bitcoin continues to reverse lower within the bull channel now trading back under the $100k mark. Price is fast approaching a test of the $91,750 level and channel lows. This is a key support zone for the market which bulls need to defend to prevent a deeper drop towards $80,185.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.