Aussie Soaring on Hawkish RBA Expectations

Strong Aussie Data

Despite the geopolitical risks which dogged the first half of the week, and still linger in the background, AUD has gone on to be the strongest FX performer against the Dollar. Alongside NZD, AUD has risen firmly this week, capitalising on a softer USD and hawkish RBA expectations. On the back of a bumper jobs report for December, traders have ramped up bets for an RBA rate hike in February with market pricing currently pegging a roughly 60% chance, up more than double from last week. The unemployment rate was seen falling back to 4.1% last month, down from 4.3% prior and below the 4.4% the market was looking for. There was further positive data overnight with the flash PMIs for the both the services and manufacturing sectors seen jumping. Services in particular soared to 56 from the prior month’s 51.1 reading, feeing into hawkish RBA expectations.

Risk-On

With geopolitical risks having subsided on the back of Trump’s EU tariff U-Turn, the rebound in risk appetite is further strengthening the bullish outlook for the Aussie here. USD has come under heavy selling pressure as the record breakout in gold earlier in the week attracted capital away from USD. Similarly, the fresh push higher in stocks, with global equities rebounding post-Davos, is keeping USD muted for now. While this backdrop remains, AUDUSD looks poised for further upside near-term.

Technical Views

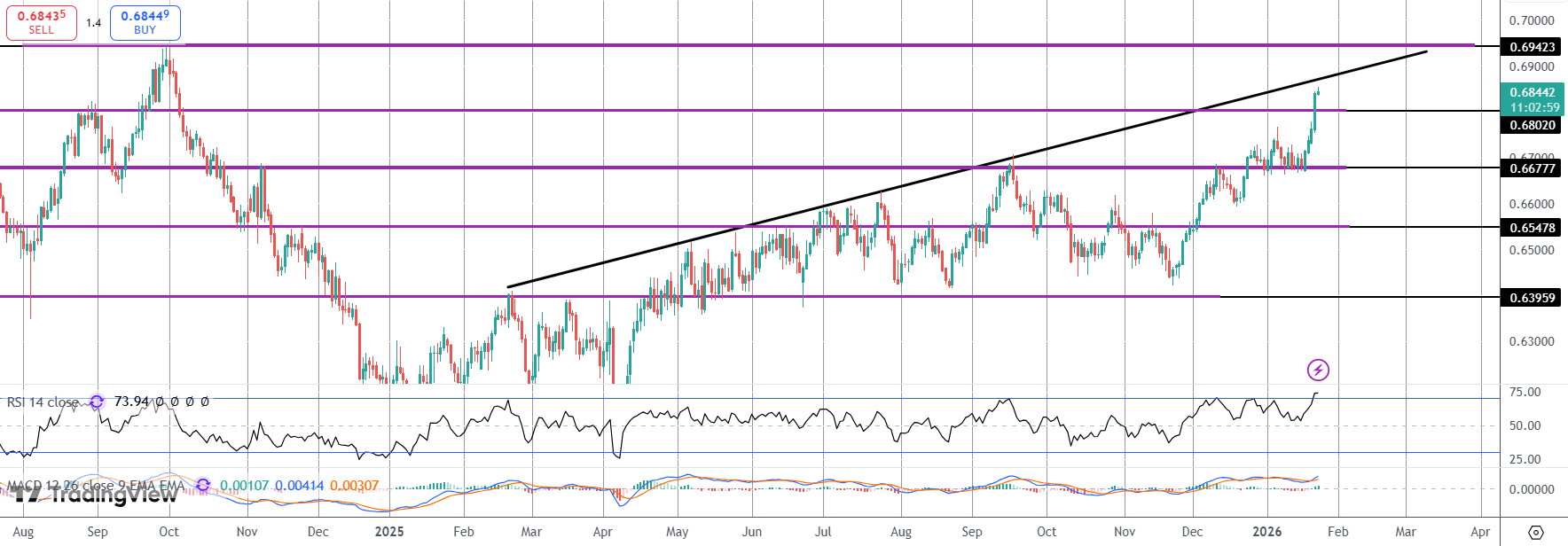

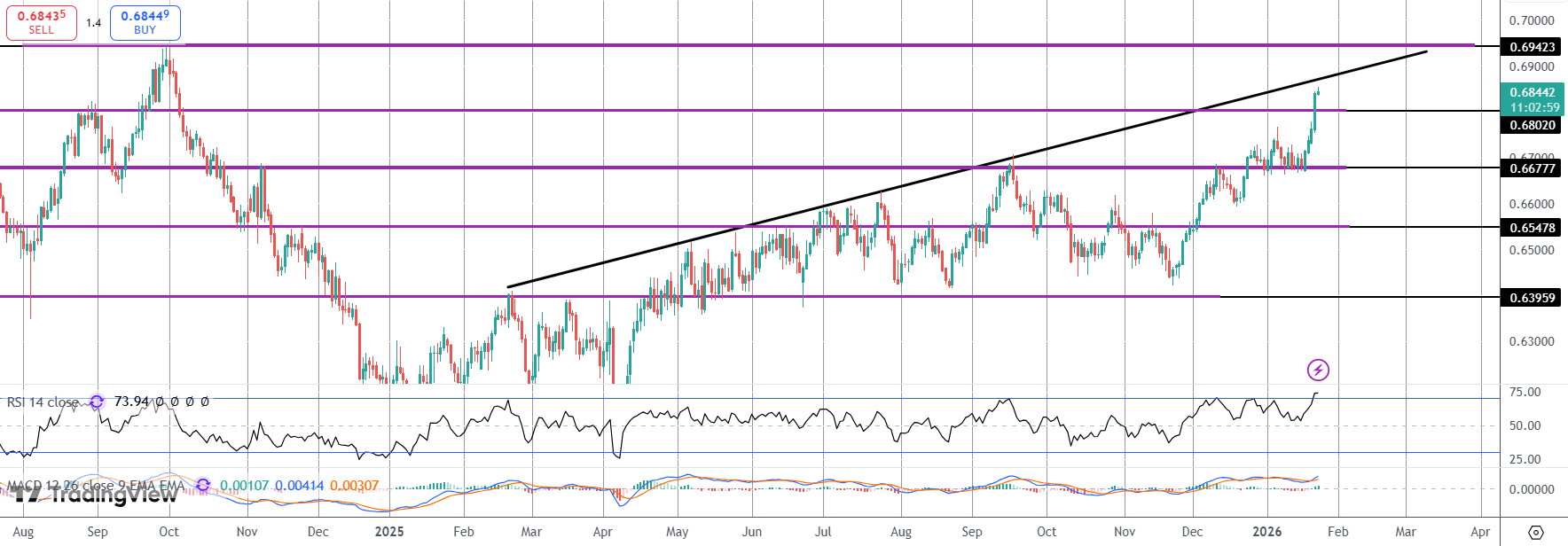

AUDUSD

The rally in AUDUSD has seen the pair breaking out to fresh YTD highs with price now above the .6802 level and fast approaching a test of the bull trend line resistance. Above here, .6942 is the next big structural resistance to note. While price remains above .6677, however, the focus is on a continuation higher near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.